Auditing Profession Act, 2005 (Act No. 26 of 2005)NoticesRegulatory Strategy for Independent Regulatory Board for AuditorsPart A : General InformationOrganisational Structure and Governance |

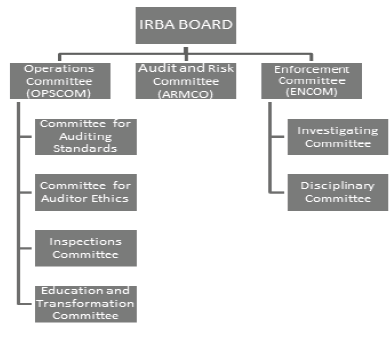

GOVERNANCE STRUCTURE

The IRBA is a juristic person established in terms of section 3 of the APA and is listed as a National Public Entity in Part A of Schedule 3 to the PFMA.

The Board is established in terms of the APA and has the governance structure and reporting lines described in the diagram below.

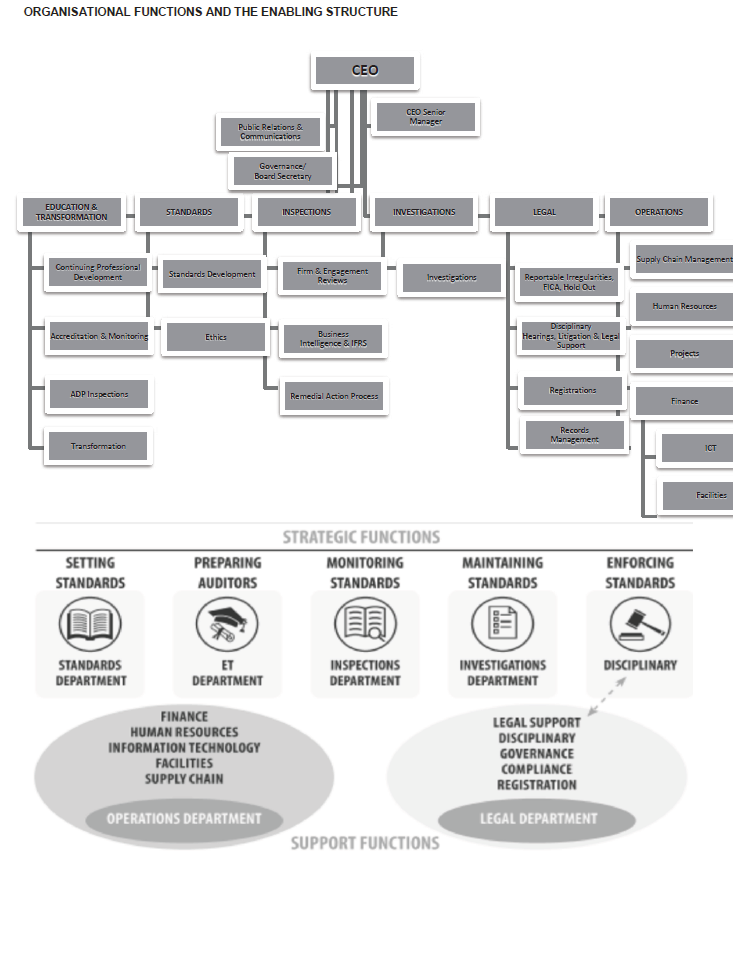

OUR FUNCTIONS THAT FULFIL OUR MANDATE

Education and Transformation

Section 7 of the APA includes functions that we have to undertake with regard to the education, training and professional development of registered auditors (RAs). Part of our mandate is to set out measures to advance the implementation of appropriate standards of competence and good ethics in the auditing profession. The Education and Transformation Committee and our Education and Transformation Department are tasked with ensuring that these objectives, which are essential to restoring and upholding confidence in the profession, are achieved. To do this, the following are the key focus areas:

| • | Competency Framework: This framework is the basis for developing the standards of competence for registered candidate auditors and RAs. These competencies are a benchmark for the accredited professional bodies’ programmes and the Continuing Professional Development (CPD) framework. |

| • | Audit Development Programme (ADP): This is the IRBA’s 18-month specialist programme for the development of RAs into the profession; and its success is critical for the sustainability of the RA register. |

| • | Accreditation and monitoring of professional bodies: These linked functions create the pipeline for entry into the ADP; and also set the standard for the underlying academic, core and professional development programmes and competencies that will lead to the registration of future RAs. |

Transformation of the Auditing Profession

To give effect to government policy on transformation, our strategic approach to transformation is to identify transformation initiatives that will address the real challenges and factors that have an impact on transformation in the RA profession. Those are initiatives that will result in more impactful outcomes that go beyond only increasing awareness; and they will be structured across the four stages of the RA career lifecycle depicted in the graphic below.

It should be emphasised, though, that to effectively influence the advancement of transformation of the profession with regard to raising awareness of the RA profession, the audience for these initiatives should include trainees, students (school learners and university students) and audit managers across the RA career lifecycle.

Standards

Important focus areas for us with regard to setting standards, as required by our mandate and achieved through our two statutory committees ‒ the Committee for Auditor Ethics (CFAE) and the Committee for Auditing Standards (CFAS) ‒ are to:

| • | Determine what constitutes improper conduct by RAs by developing rules and guidelines for professional ethics, including a code of professional conduct (CFAE); and |

| • | Develop, maintain, adopt, issue or prescribe auditing pronouncements (CFAS). |

Through setting standards that are internationally comparable and responsive to our local environment, the activities assigned to the Standards Department contribute to the organisation’s initiatives to restore confidence in the auditing profession and protect the public in its dealing with RAs.

South Africa presently adopts the entire suite of International Standards issued by the International Auditing and Assurance

Standards Board (IAASB). Also, the country has adopted the International Ethics Standards Board for Accountants (IESBA) International Code of Ethics for Professional Accountants (including International Independence Standards) (IESBA Code), which has been published as the IRBA Code (Revised November 2018), with additional requirements for RAs in South Africa.

Our philosophy around audit and ethics standard setting is to first and foremost maintain South Africa’s comparability and competitiveness with international peers. This is followed by a need to make targeted enhancements to standards for the local environment, without eroding the baseline. We then supplement our authoritative standards with local guides, industry-specific guidance and other non-authoritative materials.

Standard setting is conducted using a multi-stakeholder approach that draws on the insights and skills of stakeholders and by adopting a due process that includes formal public consultations. Standard-setting priorities are shaped by a combination of a local call for projects and the agendas of the global standard-setting boards. The projects that get assigned resources are those that are scored to be of greatest public interest, by considering the extent of engagements and practitioners affected, the law or regulation driving the change, international developments, insights from the IRBA’s regulatory functions and the availability of other guidance.

Inspections

In terms of section 47 of the APA, we are required to, among others, inspect or review the practices of RAs. This is a crucial regulatory function that gives effect to our mandate and strategy to protect the public interest and ensure that candidate auditors receive effective training, in accordance with the prescribed and applicable standards of professional competence, ethics and conduct.

The inspections, undertaken by our Inspections Department, are performed in three-year cycles. A risk-based approach is followed in selecting audit firms and engagement files for inspections, in line with international best practice.

In response to the current environment, we continue to focus on audit engagements with a higher public interest exposure, such as audits of public interest entities and state-owned companies. The Inspections Department, as a result of the concerning trend of recurring deficiencies at the audit firms, has introduced theme-based supplementary inspections.

Our mandatory Remedial Action Process plays a critical role in identifying the most appropriate follow-up action where deficiencies have been reported. These actions may include a follow-up on the Root Cause Analysis and the Remedial Action Plan; verifying specific action required by the Inspections Committee; and/or they could trigger a specific follow-up inspection or a follow-up during the next firm-wide inspection. We have also enhanced this process to include a proactive monitoring function that provides an opportunity for the audit firm and auditors to immediately remediate any deficiencies identified, with an opportunity to obtain a supplementary report that highlights the remediation process undertaken by the firm or auditor and the effectiveness thereof.

Investigations

A key legislative mandate of the APA is to investigate allegations of improper conduct and provide for disciplinary action regarding the improper conduct of RAs and registered candidate auditors (RCAs). The Investigations Department is tasked with investigating complaints (both external and internal) and presenting these findings to the Investigating Committee (INVESCO).

The Enforcement Committee (ENCOM) is responsible for dealing with the recommendations of INVESCO. Where there is evidence of improper conduct, ENCOM will mainly follow the admission of guilt process, in a small number of instances, where warranted refer the matter to the Disciplinary Committee (DISCOM).

Investigating and taking disciplinary action ensure that there are consequences when improper conduct is identified in the profession. This is an important aspect of protecting the public interest and safeguarding the integrity of the financial markets, as the reliance on audit opinions and financial statements is a cornerstone of a financial market that operates effectively.

The sanctions that ENCOM may impose for improper conduct by RA’s and RCA’s are: a caution or reprimand, a monetary fine, and non-monetary sanctions such as training or the enhancement of internal controls.

Through this function, we enforce compliance with the international accounting and auditing l standards and the IRBA Code of Professional Conduct by administering sanctions against RAs and RCAs who act improperly. Our objective is to promote public confidence through the regulation of the auditing profession and the way in which improper conduct is addressed.

Legal

The department delivers on its legislative mandate through four functions: Registry, Reportable Irregularities (RIs), Legal and Records Management.

In addition to the above, the department is a support function to the organisation, mandated to protect the IRBA’s interests by managing legal and compliance risks, through the provision of sound legal advice, mitigation of litigation and contractual risks, as well as supporting the organisation’s compliance with legislation.

Registry: Registration of Auditors and Audit Firms

Registry works closely with the Education and Transformation Department to ensure the competency of auditors and firms that are entered into the register of auditors. This inter-departmental co-operation promotes knowledge and skills sharing, while streamlining processes, resulting in greater efficiencies and quality in the registration processes.

It is through these processes that the IRBA is able to ensure that RAs who are entered into the register are competent, fit and proper to practise the auditing profession, thereby ensuring the credibility and reliability of auditors, maintaining the integrity of the profession, fostering public confidence in audit products and safeguarding the interests of those who utilise the services of RAs.

RIs: Administration of Reportable Irregularities

RAs have a statutory duty to report any unlawful act or omission committed by persons responsible for the management of an entity for which the RA is engaged. Such acts include those that may result in material financial loss for the entity, are fraudulent or may result in a material breach of that person’s fiduciary duty to the entity.

The duty to report RIs is particularly important because of the duty owed by an RA to act in the public interest.

The IRBA’s primary function with regard to RIs is the onward reporting of the irregularities reported by the RA to the relevant regulator with authority to take appropriate action against the entity concerned and/or its management, thus creating scope for the irregularity to be dealt with appropriately and the affected interests to be vindicated.

Legal: Disciplinary Hearings

An RA/RCA charged with improper conduct by the IRBA may be subject to a disciplinary hearing, if ENCOM refers the matter to DISCOM. To preserve the impartiality and credibility of disciplinary hearings, the APA obliges the IRBA to establish a disciplinary committee constituted by independent, non-RA members who are not within the employ of the IRBA and/or any registered audit firm. Members appointed to DISCOM are also required to possess sufficient qualifications, skills and expertise, to ensure the fairness and appropriateness of the disciplinary outcomes.

The decisions of DISCOM are final and binding to both the IRBA and the RA/RCA, and are only subject to a review in terms of the Promotion of Administration of Justice Act 3 of 2000, read together with Rule 53 of the Superior Court Rules. This then mitigates delays in the actual finalisation of matters.

The IRBA acknowledges that the current state of the profession has increased the number and complexity of disciplinary matters requiring determination by DISCOM. To address this, the IRBA has adopted a disciplinary processes strategy that is premised on three focus areas: agility, efficiency and effectiveness. The overall objective of the strategy is to focus on moving matters quickly from referral to conclusion, with minimum wasted effort and/or expenses, while ensuring the achievement of optimal results for the IRBA, thus, minimising risks, restoring confidence and preserving the integrity of the IRBA and its processes.

The sanctions, as outlined in the APA, are inclusive of a permanent and temporary disqualification from practice; non-monetary sanctions, such as training and the enhancement of internal controls; increased monetary sanctions; and the mandatory publication of the outcomes of disciplinary matters, to ensure that we achieve both the deterrence and rehabilitation of RAs and RCAs subjected to disciplinary hearings.

Records Management: Protection and Access to Information and Records

The records management function, while mandated to ensure the IRBA’s record-keeping complies with relevant records management legislation, is equally tasked with ensuring our compliance with section 57 of the APA and the POPI Act.

Operations

As a national public entity, the IRBA is subject to the governance, financial control and reporting framework of the PFMA. In terms of the PFMA, the IRBA is required to establish effective, efficient and transparent systems of financial and risk management and internal control, to manage and safeguard the assets, as well as manage the revenue, expenditure and liabilities of the organisation.

The Operations Department is responsible for the preparation of the IRBA’s strategic and annual performance plans, in accordance with National Treasury guidelines. This includes the annual and periodic reporting of performance against predetermined targets to National Treasury, the Minister of Finance and Parliament.

Compliance, accountability and the proper management of revenue, expenditure, assets and liabilities are some of the important measures that we use to assess our operational effectiveness. The measurable indicator of how well these measures are functioning is a clean external auditor’s report, which we have obtained annually since 2010.

Our overall focus areas are:

| • | The effective, efficient and economical use of IRBA resources. |

| • | Maintaining an IT infrastructure that supports the optimal functioning of the IRBA. |

| • | Remaining an employer of choice, to enable the attraction and retention of our most critical resources – our employees. |

| • | Complying with relevant legislation and maintaining an effective system of internal controls. |

The challenges of the COVID-19 pandemic have been felt keenly within the IRBA and by our stakeholders. Despite the situation, the safety and wellbeing of our employees and stakeholders have been key priority areas for us. As we navigate the newly defined and constantly evolving work environment, we will continue to comply with all relevant legislation and guidance from the health and labour authorities.