Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (11) Method 1 : Calculation of credit risk exposure in terms of the foundation IRB approachSubregulation (11)(m) Securitisation exposure: Formulation of supervisory parameter (p) |

[Regulation 23 (11)(m) heading substituted by section 2(ii) of Notice No. 2561, GG46996, dated 30 September 2022]

| (m) | Securitisation exposure: Formulation of supervisory parameter (p) |

(i) The supervisory parameter p in the context of the SEC-IRBA is as follows:

p=max[0.3; (A + B*(1/N) + C*KIRB + D*LGD + E*MT)],

where:

| 0.3 | denotes the p-parameter floor; |

| N | is the effective number of loans in the underlying pool, calculated as described in subregulation (n) below; |

| KIRB | is the capital charge of the underlying pool (as defined in subregulation 11(k)(i) above) |

| LGD | is the exposure-weighted average loss-given-default of the underlying pool, calculated as described in subregulation (o) below; |

| MT | is the maturity of the tranche calculated according to subregulation (6)(h)(xviii); |

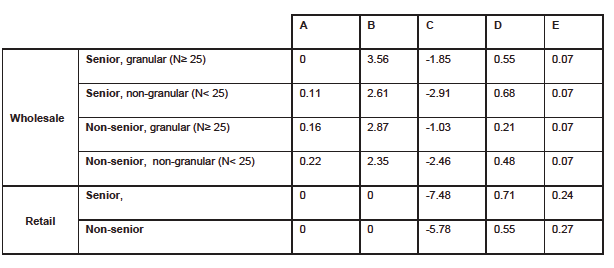

and the parameters A, B, C, D, and E are determined according to the following look-up table:

| (ii) | If the underlying IRB pool consists of both retail and wholesale exposures, the pool should be divided into one retail and one wholesale subpool and, for each subpool, a separate p-parameter (and the corresponding input parameters N, KIRB and LGD) should be estimated. A weighted average parameter for the transaction should be calculated on the basis of the parameters of each subpool and the nominal size of the exposures in each subpool. |

| (iii) | If a bank applies the SEC-IRBA to a mixed pool as described in subregulation (6)(h)(i), the calculation of the p-parameter should be based on the IRB underlying assets only and the SA underlying assets should not be considered for this purpose. |

[Regulation 23 (11)(m) substituted by section 2(ii) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]