| (i) | Subject to such conditions as may be specified in writing by the Registrar, a bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall apply the said approach in respect of all material asset classes and business units. |

| (ii) | For a minimum period of three years prior to a bank's implementation of the advanced IRB approach for the measurement of the bank's exposure to credit risk, the rating and risk estimation systems and processes of the bank should have— |

[Subparagraph (ii) of subregulation (13)(b) substituted by regulation 2(dd) of Notice No. R. 261 dated 27 March 2015]

(A) provided a meaningful assessment of borrower and transaction characteristics;

| (B) | provided a meaningful differentiation of risk; |

| (C) | provided materially accurate and consistent quantitative estimates of risk, including PD ratios, LGD ratios and EAD amounts; |

| (D) | produced internal ratings and default and loss estimates that formed an integral part of the bank's— |

| (i) | credit approval process; |

| (ii) | risk management process; |

| (iii) | internal capital allocation process; |

| (iv) | corporate governance process; |

| (E) | been subjected to appropriate independent review; |

| (F) | been broadly in compliance with the relevant minimum requirements specified in subregulation (11) above; |

[Regulation 23(13)(b)(ii)(F) substituted by regulation 6(w) of Notice No. R. 297, GG 40002, dated 20 May 2016]

| (G) | been broadly in compliance with the relevant minimum requirements relating to own estimates of LGD and EAD specified in this subregulation (13). |

[Regulation 23(13)(b)(ii)(G) inserted by regulation 2(ee) of Notice No. R. 261 dated 27 March 2015]

| (iii) | A facility rating of a bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall exclusively reflect the LGD ratio of the particular exposure, provided that— |

| (A) | a facility rating shall include all factors that may have an influence on the LGD ratio, such as the type of collateral, the product, the industry or the purpose; |

| (B) | any borrower characteristics shall be included as LGD rating criteria only to the extent that such characteristics are predictive of LGD; |

| (C) | the bank shall maintain a sufficient number of facility grades in order to avoid the grouping of facilities with widely varying LGD ratios into a single grade. |

| (iv) | A bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall in the case of exposures to corporate institutions, sovereigns and banks collect and store data in respect of— |

| (A) | the LGD ratios and EAD estimates associated with each relevant facility; |

| (B) | the key data that was used to derive a particular risk estimate; |

| (C) | the person or model responsible for a particular risk estimate; |

| (D) | the estimated and realised LGD ratios and EAD amounts associated with each relevant defaulted facility; |

| (E) | the credit risk mitigating effects of guarantees or credit-derivative instruments on LGD ratios, that is, the bank shall retain data in respect of the LGD ratio of the facility before and after the effect of a guarantee or credit-derivative instrument was taken into consideration; |

| (F) | the components of loss or recovery for each defaulted exposure such as the amounts recovered, the source of recovery, for example, collateral, liquidation proceeds and guarantees, the time period required for recovery and administrative costs. |

Unless specifically otherwise provided in this subregulation (13), a bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk—

| (A) | shall in the case of exposures to corporate institutions, sovereigns or banks estimate a PD ratio in respect of each internal borrower grade, which PD estimate shall comply with the relevant minimum requirements specified in subregulation (11)(b)(vi)(A) above; |

| (B) | shall in the case of retail exposures estimate a PD ratio in respect of each relevant retail pool of exposures, which PD estimate shall comply with all the minimum requirements specified in subregulation (11)(b)(vi)(B) above; |

| (C) | shall estimate an appropriate LGD ratio in respect of all relevant facilities and asset classes, which LGD ratio— |

| (i) | shall incorporate all relevant and material data and information, including conditions relating to an economic downturn when such information is necessary to duly capture the relevant risk; |

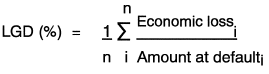

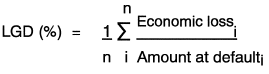

| (ii) | shall not be less than the long-run default-weighted average loss rate given default, based on the average economic loss of all observed defaults within the data source for a particular type of facility, which default-weighted average loss rate given default shall be calculated in accordance with the formula specified below: |

For example, when a bank's pool of defaulted exposures consists of 75 defaults where the exposure at default is R10 000 and the bank suffered a complete loss, that is, an LGD ratio of 100%, and 25 defaults where the exposure at default was R1 000 000 but the bank lost only R200 000, that is, an LGD ratio of 20%, the bank's default-weighted average LGD shall be calculated as:

| (iii) | shall be based on the definition of default, specified in regulation 67; |

| (iv) | may be based on averages of loss severities observed during periods of high credit losses, obtained from internal and/or external data, provided that the data shall be representative of long run experience; |

| (v) | shall appropriately incorporate any potential correlation or dependence between the risk relating to the borrower and the collateral, collateral provider or protection provider; |

| (vi) | shall incorporate the effect of a currency mismatch between the underlying obligation and any collateral obtained; |

| (vii) | shall be based on historical recovery rates and empirical evidence and not, for example, solely on the estimated market value of collateral; |

| (viii) | shall be based on a population of exposures that closely matches or is at least comparable to the bank's existing exposures and lending standards; |

| (ix) | shall be based on economic and market conditions that are relevant and current; |

| (x) | shall be based on a sufficient number of exposures and data periods that will ensure accurate and robust LGD estimates; |

| (xi) | shall be based on an estimation technique that performs well in out-of-sample tests; |

| (xii) | shall be reviewed on a regular basis but not less frequently than once a year, or when material new information is obtained; |

| (xiii) | shall in the case of— |

| (aa) | defaulted assets reflect the possibility that the bank may have to recognise additional, unexpected losses during the recovery period; |

| (bb) | exposures to corporate institutions, sovereigns or banks be based on a minimum data observation period that covers a complete economic cycle but which observation period shall in no case be less than seven years in respect of at least one of the bank's data sources; |

| (cc) | retail exposures be based on a minimum data observation period of no less than five years, provided that the bank may with the prior written approval of the Registrar place more reliance on recent data when the said data better reflects loss rates in respect of the bank's retail exposures; |

| (D) | shall estimate an appropriate EAD amount in respect of all relevant facilities and asset classes, which EAD amount— |

| (aa) | on-balance-sheet items be no less than the current drawn amount after the effect of set-off in terms of the provisions of regulation 13 has been taken into consideration; |

| (bb) | off-balance-sheet items, excluding derivative instruments, be based on the bank's internal estimates for each facility type provided that the said internal estimates shall incorporate the possibility that further amounts may be drawn by the obligor up to and after the time of default; |

| (cc) | derivative instruments be calculated in accordance with the relevant directives and requirements specified in subregulations (15) to (19) below; |

| (dd) | exposures to corporate institutions, sovereigns or banks be based on a complete economic cycle, provided that— |

| (i) | the time period on which the EAD amount is based shall in no case be less than seven years; |

| (ii) | the EAD estimates shall be based on a defaultweighted average and not a time-weighted average amount; |

| (ee) | retail exposures be based on a data observation period of no less than five years, provided that the bank may with the prior written approval of the Registrar place more reliance on recent data when the said data better reflect likely draw-downs in respect of the bank's retail exposures; |

| (ii) | shall be an estimate of the long-run default-weighted average EAD amounts in respect of similar facilities and borrowers over a sufficiently long period of time; |

| (iii) | shall incorporate any correlation between the default frequency and the extent of EAD amounts; |

| (iv) | shall incorporate the effects of downturns in the economy, that is, the risk drivers of the bank's internal model or the bank's internal data or external data shall incorporate the cyclical nature of each facility; |

| (v) | shall be based on criteria that are plausible and intuitive; |

| (vi) | shall appropriately take into consideration all relevant and material information; |

| (vii) | shall be based on the definition of default, specified in regulation 67; |

| (viii) | shall be based on a population of exposures that closely matches or is at least comparable to the bank's existing exposures and lending standards; |

| (ix) | shall be based on economic and market conditions that are relevant and current; |

| (x) | shall be based on a sufficient number of exposures and data periods that will ensure accurate and robust estimates of EAD amounts; |

| (xi) | shall be based on an estimation technique that performs well in out-of-sample tests; |

| (xii) | may take into account data from external sources, including pooled data, provided that the EAD estimates shall represent long-run experience; |

| (xiii) | shall be based on historical experience and empirical evidence; |

| (xiv) | shall be reviewed on a regular basis, but not less frequently than once a year, or when material new information is obtained; |

| (xv) | shall be based on comprehensive policies, systems and procedures, which policies, systems and procedures shall be adequate— |

| (aa) | to prevent further drawings in circumstances short of payment default, such as covenant violations or other technical default events; |

| (bb) | to monitor, on a daily basis, facility amounts and current outstanding amounts against committed lines; |

| (cc) | to monitor any changes in outstanding amounts per borrower, and per risk grade; |

| (E) | shall in the case of exposures to corporate institutions, sovereigns or banks calculate the effective maturity in respect of each relevant exposure, which effective maturity shall be calculated in accordance with and comply with the relevant minimum requirements specified in paragraph (d)(ii)(B) below. |

| (vi) | Validation of internal estimates |

As a minimum, a bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk—

| (A) | shall comply with the relevant requirements specified in subregulation (11)(b)(x) above and such further conditions as may be specified in writing by the Registrar; |

| (B) | shall for each relevant risk grade regularly compare realised PD ratios, LGD ratios and EAD amounts with estimated PD ratios, LGD ratios and EAD amounts, and demonstrate to the satisfaction of the Registrar that the realised risk components are within the expected range of risk components for a particular grade; |

| (C) | shall duly document the data and methods used to compare realised default rates, LGD ratios and EAD amounts with estimated PD ratios, LGD ratios and EAD amounts in respect of each relevant risk grade, including the periods that were covered and any changes in the data and methods that were used, which analysis and documentation shall be updated at appropriate intervals but not less frequently than once every year; |

| (D) | shall have in place sufficiently robust internal standards to deal with situations where realised PD ratios, LGD ratios and EAD amounts substantially deviate from expected PD ratios, LGD ratios and EAD amounts provided that when the realised values continue to be higher than the expected values, the bank shall adjust its estimates of risk components upward in order to reflect the appropriate default and loss experiences of the bank. |