Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (6) Method 1: Calculation of credit risk exposure in terms of the simplified standardised approach |

| (6) | Method 1: Calculation of credit risk exposure in terms of the simplified standardised approach |

Unless specifically otherwise provided in these Regulations, a bank that adopted the simplified standardised approach for the measurement of the bank's exposure to credit risk arising from positions held in its banking book shall risk weight its relevant exposure, net of any credit impairment, in accordance with the relevant requirements specified below:

| (a) | In the case of exposure to sovereigns, central banks, public-sector entities, banks, securities firms and corporate institutions, in accordance with the provisions of table 1 below. |

Table 1

Claim in respect of— |

Export Credit Agencies: risk scores relating to sovereign1 |

||||||||||||||

0-1 |

2 |

3 |

4 to 6 |

7 |

|||||||||||

Sovereigns (including the Central Bank of that country) |

0% |

20% |

50% |

100% |

150% |

||||||||||

Public sector entities |

20% |

50% |

100% |

100% |

150% |

||||||||||

Banks 2 3 |

20% |

50% |

100% |

100% |

150% |

||||||||||

Securities firms 2 3 5 |

20% |

50% |

100% |

100% |

150% |

||||||||||

Banks: short-term claims 4 |

20% |

20% |

20% |

50% |

150% |

||||||||||

Securities firms: short-term claims 4 5 |

20% |

20% |

20% |

50% |

150% |

||||||||||

Corporate entities |

Any corporate exposure, including claims on insurance companies |

||||||||||||||

100% |

|||||||||||||||

|

|||||||||||||||

| (b) | In the case of an exposure that meets the criteria specified below, which exposure shall be regarded as forming part of the bank's retail portfolio, excluding any exposure that is overdue, at a risk weight of 75 per cent. |

| (i) | Criteria relating to orientation |

The exposure shall relate to an individual person or persons or to a small business.

| (ii) | Criteria relating to the product |

The exposure shall be in the form of—

| (A) | a revolving credit exposure or line of credit, including exposures relating to credit cards and overdraft facilities; |

| (B) | a personal term loan or lease, including instalment loans, vehicle finance and leases, student and educational loans and personal finance; or |

| (C) | a small business facility or commitment, |

provided that the exposures specified below shall at no stage form part of a bank's retail portfolio.

| (i) | Securities such as bonds and equities, whether listed or not. |

| (ii) | Mortgage loans that qualify for inclusion in the category of claims secured by residential property. |

| (iii) | Criteria relating to granularity |

In order to ensure that the retail portfolio of the reporting bank is sufficiently diversified, no aggregate exposure to a counterparty shall exceed 0.2% of the aggregate amount relating to the bank's retail portfolio.

For the purposes of this subparagraph (iii)—

| (A) | aggregate exposure means the gross amount of all forms of debt included in the retail portfolio before any form of credit risk mitigation is taken into consideration; |

| (B) | counterparty means one or more persons or entities that may be considered a single beneficiary, including small businesses affiliated to each other; and |

| (C) | all retail exposures that are overdue as envisaged in paragraph (e) below shall be excluded from the aggregate amount when the bank calculates the said granularity of the retail portfolio. |

| (iv) | Low value of individual exposures |

An exposure to an individual person or small business shall be included in the retail portfolio only when the aggregate amount of the said exposure after the application of the relevant credit conversion factors but before the effect of any risk mitigation is taken into consideration, is less than or equal to such an amount as may be specified in writing by the Registrar from time to time.

[Regulation 23(6)(b)(iv) substituted by regulation 6(d) of Notice No. 297, GG 40002, dated 20 May 2016]

| (c) | In the case of lending fully secured by mortgage on an occupied urban residential dwelling or occupied individual sectional title dwelling, when the exposure is not overdue for more than 90 days, and to the extent that the capital amount outstanding— |

| (i) | does not exceed 80 per cent of the current market value of the mortgaged property, at a risk weight of 35 per cent; |

| (ii) | exceeds 80 per cent but is less than 100 per cent of the current market value of the mortgaged property, at a risk weight of 75 per cent; |

| (iii) | is equal to or exceeds 100 per cent of the current market value of the mortgaged property, at a risk weight of 100 per cent, |

For example, when a bank granted and paid out a loan of R1 050 000 to a borrower, which loan is fully secured by mortgage on an occupied urban residential dwelling, the current market value of which urban residential dwelling is equal to R1 million, the bank shall risk weight the loan as follows:

| (i) | R800 000 at 35 per cent; |

| (ii) | R199 999 at 75 per cent; and |

| (iii) | R 50 001 at 100 per cent. |

Occupied

For the purposes of this paragraph (c), only urban residential dwellings or individual sectional title dwellings that are occupied or intended to be occupied as the principal place of residence of either the borrower or, with the consent of the borrower, a person other than the borrower shall be regarded as adhering to the requirement of being "occupied". In this regard, although the intention of the borrower may be an important indicator, the purpose for which the dwelling is/will be utilised shall be determined with reference to objective factors and reasonability. For example, the fact that the residence may be unoccupied for short periods of time, such as when the resident is on vacation, does not change the classification. On the other hand, a residence used mainly for purposes of vacation or to conduct business activities can clearly not be regarded as the principal place of residence.

Urban

For the purposes of this paragraph (c), urban area means an area inside the boundaries of any local government area fixed by law.

Dwelling

For the purposes of this paragraph (c), dwelling means any building that—

| (i) | after its construction contains or will contain living rooms with a kitchen and the usual appurtenances and permanent provision for lighting, water supply, drainage and sewerage, whether such building is or is to be constructed as a detached or semi-detached building or is or is to be contained in a block of buildings; |

| (ii) | is designed and utilised or meant to be utilised for residential purposes; and |

| (iii) | is located in an area— |

| (A) | in which the majority of the premises are residential premises; or |

| (B) | comprising at least 100 residential premises and which is defined for this purpose by means of cadastral boundaries, as shown on the compilation maps of the Surveyor General. |

| (d) | In the case of lending fully secured by mortgage on commercial real estate, at a risk weight of 100 per cent. |

| (e) | In the case of an exposure, other than an exposure secured by a mortgage bond on residential property as envisaged in paragraph (c), which exposure is overdue for more than 90 days— |

| (i) | the unsecured portion of the exposure shall be risk weighted as follows: |

| (A) | 150 per cent when the specific credit impairment in respect of the outstanding amount of the exposure is less than 20 per cent; |

| (B) | 100 per cent when the specific credit impairment in respect of the outstanding amount of the exposure is equal to or more than 20 per cent; |

| (C) | 50 per cent when the specific credit impairment in respect of the outstanding amount of the exposure is equal to or more than 50 per cent. |

| (ii) | the secured portion of the exposure shall be risk weighted at 100 per cent, provided that the bank obtained adequate eligible collateral and raised a specific credit impairment equal to or higher than 15 per cent of the outstanding exposure. |

| (f) | In the case of a loan that is fully secured by a mortgage bond on an occupied urban residential dwelling or occupied individual sectional title dwelling as envisaged in paragraph (c), which loan is overdue for more than 90 days, |

| (i) | at a risk weight of 100 per cent when the specific credit impairment in respect of the loan is less than 20 per cent of the outstanding amount; |

| (ii) | at a risk weight of 50 per cent when the specific credit impairment in respect of the loan is equal to or higher than 20 per cent of the outstanding amount. |

| (g) | In the case of off-balance-sheet exposure, other than— |

| (i) | unsettled securities; |

| (ii) | derivative contracts subject to counterparty credit risk as envisaged in subregulations (15) to (19); |

| (iii) | posted collateral that is subject to the relevant requirements specified in subregulation (18) relating to the standardised approach for counterparty credit risk or in subregulation (19) relating to the internal model method for counterparty credit risk; or |

| (iv) | securitisation or resecuritisation exposure as envisaged in paragraph (h) below, |

the bank shall convert the off-balance-sheet exposure to a credit equivalent amount by multiplying the said exposure with the relevant credit-conversion factor specified in table 2 below

[Regulation 23(6)(g) substituted by section 3(b) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

Table 2

Description |

Credit conversion factor |

||||

Any solicitation limit, that is, a facility not yet contracted |

0 per cent |

||||

Any revocable commitment 1 |

0 per cent |

||||

Drawn self-liquidating trade letters of credit arising from the movement of goods, that is, documentary credits collateralised by the underlying shipment, with an original maturity of up to one year, which credit conversion factor shall apply to both issuing and confirming banks |

20 per cent 2 |

||||

Irrevocable commitments with an original maturity of up to one year, excluding any commitment which is renewed or rolled resulting in an effective maturity of more than one year |

20 per cent |

||||

Drawn self-liquidating trade letters of credit arising from the movement of goods, that is, documentary credits collateralised by the underlying shipment, with an original maturity of more than one year |

50 per cent |

||||

Irrevocable commitments with an original maturity of more than one year and commitment which is renewed or rolled resulting in an effective maturity of more than one year |

50 per cent |

||||

Performance related guarantees |

50 per cent |

||||

Irrevocable note issuance facilities and irrevocable revolving underwriting facilities |

50 per cent |

||||

Any exposure arising from a securities lending/borrowing transaction |

100 per cent |

||||

Direct credit substitutes such as general guarantees of indebtedness, including standby letters of credit serving as financial guarantees, and acceptances |

100 per cent |

||||

Any relevant off-balance-sheet exposure rated by an eligible external credit assessment institution |

100 per cent |

||||

Off-balance-sheet exposures other than the exposures specified above |

100 per cent |

||||

|

|||||

| (h) | In the case of a securitisation exposure and resecuritisation exposure, in accordance with the relevant requirements specified below: |

| (i) | securitisation exposures will be treated differently depending on the type of the underlying exposures and/or the type of information available to the bank and in terms of the following: |

| (A) | the hierarchy of approaches for a securitisation exposure as follows: |

| (i) | For a securitisation exposure of an Internal-Ratings Based (IRB) pool as defined in this subregulation (6)(h)(i)(B), a bank must use the Securitisation Internal Ratings-Based Approach (SEC-IRBA) as described in subregulation (11)(k), unless otherwise determined by the Authority; |

| (ii) | For a securitisation exposure to a Standardised Approach (SA) pool as defined in subregulation 6(h)(i)(C), and where a bank cannot use the SEC-IRBA, it must use the Securitisation External Ratings-Based Approach (SEC-ERBA) as described in this subregulation (6)(h)(j)(l)(B) provided that— |

| (aa) | the exposure has an external credit assessment that meets the operational requirements for an external credit assessment as set out in regulation 38(6); or |

| (bb) | there is an inferred rating that meets the operational requirements for inferred ratings as set out in subregulation (6)(h)(j)(l)); |

| (iii) | A bank may use an Internal Assessment Approach (IAA) as described in subregulation (11)(g) for an unrated securitisation exposure (e.g. liquidity facilities and credit enhancements) to a SA pool within an ABCP programme provided that the bank: |

| (aa) | has supervisory approval to use the IRB approach, subject to such further requirements as may be specified in writing by the Authority from time to time, and |

| (bb) | consults with the Authority on whether and when it can apply the IAA to its securitisation exposures, especially where the bank can apply the IRB for some, but not all, underlying exposures. To ensure appropriate capital levels, there may be instances where the Authority requires a treatment other than this general rule; |

| (iv) | A bank may use the Securitisation Standardised Approach (SEC-SA) as described in this subregulation (6)(h)(j)(l) for its exposure to an SA pool if the bank cannot use the SEC-ERBA or the IAA. |

| (v) | For a securitisation exposure of a mixed pool as defined in this subregulation 6(h)(i)(D), where the bank— |

| (aa) | can calculate KIRB on at least 95% of the underlying exposure amounts of a securitisation, the bank must apply the SEC-IRBA calculating the capital charge for the underlying pool as: |

d* KIRB + (1-D)*KSA,

where:

d is the percentage of the exposure amount of underlying exposures for which the bank can calculate KIRB over the exposure amount of all underlying exposures:

KIRB is as defined in subregulation (11); and

KSA is as defined in subregulation (6)(h)(j)(l)(B);

| (bb) | cannot calculate KIRB on at least 95% of the underlying exposures, the bank must use the hierarchy for securitisation exposures of SA pools as set out in subparagraphs (ii), (iii) and (iv) above. |

| (vi) | Securitisation exposures to which none of the approaches as contemplated in this subregulation apply must be assigned a 1250% risk weight. |

| (B) | An IRB pool relates to a securitisation pool for which the bank is able to use the IRB approach to calculate capital requirements for all underlying exposures provided that – |

| (i) | the bank— |

| (aa) | has approval from the Authority to apply the IRB approach for the type of underlying exposures; and |

| (bb) | has sufficient information to calculate IRB capital requirements for these exposures; |

| (ii) | where the bank is unable to calculate capital requirements for the entire underlying pool of exposures using an IRB approach, it should be able to demonstrate to the Authority why it cannot do so; |

| (iii) | in certain cases, the Authority may prohibit a bank from treating a pool as an IRB pool in the case of particular structures or transactions, including transactions with highly complex loss allocations; tranches whose credit enhancement could be eroded for reasons other than portfolio losses; and tranches of portfolios with high internal correlations (such as portfolios with high exposure to single sectors or with high geographical concentration). |

| (C) | A SA pool relates to a securitisation pool for which the bank— |

| (i) | does not have approval to calculate IRB parameters for any underlying exposures; or |

| (ii) | is unable to calculate IRB parameters for any underlying exposures because of lack of relevant data, notwithstanding the fact that the bank has approval to calculate IRB parameters for some or all of the types of underlying exposures; or |

| (iii) | is prohibited by the Authority from treating the pool as an IRB pool as specified in sub-paragraph (6)(h)(i)(A)(i) above. |

| (D) | A mixed pool means a securitisation pool for which the bank is able to calculate IRB parameters for some, but not all, underlying exposures in a securitisation; |

| (E) | The risk-weighted exposure amount for a securitisation exposure is computed by multiplying the exposure amount, as defined in subregulation (F) below, by the appropriate risk weight determined in accordance with the hierarchy of approaches as contemplated in this subregulation 6(h)(i)(A) provided that— |

| (i) | the maximum risk weight caps for senior securitisation exposures shall be calculated in accordance with subregulation (6)(h)(iii); |

| (ii) | the maximum capital requirement for securitisation exposures, other than senior exposures as contemplated in subparagraph (i) above, may be calculated in accordance with subregulation (xvii); |

| (iii) | overlapping exposures will be risk-weighted as contemplated in subregulation (ix). |

| (F) | For purposes of subregulation (E) above, the securitisation exposure amount is the sum of the on-balance sheet amount of the exposure and the off-balance sheet exposure, where applicable, and where— |

| (i) | the on-balance sheet exposure is the carrying value, which takes into account purchase discounts and specific credit impairments raised against the securitisation exposure; |

| (ii) | the off-balance sheet exposure is calculated as follows: |

| (aa) | for credit risk mitigants sold or purchased by the bank, the bank must use the treatment set out in subregulation 7(e) read with the relevant requirements specified in subregulation (9); |

| (bb) | for derivatives contracts (other than credit derivatives contracts), such as interest rate or currency swaps sold or purchased by the bank, apply the approach used by the bank for calculating counterparty credit risk exposures as specified in subregulations (15) to (19); |

| (cc) | for facilities that are not credit risk mitigants, use a credit conversion factor of 100%. If contractually provided for, servicers may advance cash to ensure an uninterrupted flow of payments to investors provided the servicer is entitled to full reimbursement and this right is senior to other claims on cash flows from the underlying pool of exposures and in the case of any undrawn portion of servicer cash advances or facilities that is unconditionally cancellable by the said bank without prior notice, may apply a credit conversion factor of nil in respect of the said undrawn portion provided that— |

| (i) | the said facility shall duly state that the servicing agent is under no obligation to advance funds to investors or the special purpose institution in terms of the servicer cash advance facility; |

| (ii) | any cash advance made by the servicing agent shall be at the servicing agent’s sole discretion and solely to cover an unexpected temporary shortfall that arose from delayed payments; |

| (iii) | the servicing agent’s rights for reimbursement in terms of the said cash advance facility shall be senior to any other claim on cash flows arising from underlying exposures or collateral held in respect of the securitisation scheme; |

| (iv) | the undrawn amount is calculated using a conservative method; |

| (v) | a bank that acts as an originator shall in no case provide any servicer cash advance facility in respect of the securitisation scheme in respect of which that bank acts as such an originator. |

[Regulation 23 (6)(h) substituted by section 2(a) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

Table 3

Long-term rating category 1 |

|||||

External credit assessment |

AAA to AA- |

A+ to A - |

BBB+ to BBB- |

BB+ to BB- 2 |

B+ and below or unrated 3 4 5 |

Securitisation exposure |

|||||

Risk weight |

20% |

50% |

100% |

350% |

1250% 3 4 |

Resecuritisation exposure |

|||||

Risk weight |

40% |

100% |

225% |

650% |

1250% 3 4 |

Short-term rating category 1 |

||||||||||||||

External credit assessment |

A-1/P-1 |

A-2/P-2 |

A-3/P-3 |

All other ratings or unrated |

||||||||||

Securitisation exposure |

||||||||||||||

Risk weight |

20% |

50% |

100% |

1250% |

||||||||||

Resecuritisation exposure |

||||||||||||||

Risk weight |

40% |

100% |

225% |

1250% 3 |

||||||||||

|

||||||||||||||

[Regulation 23(6)(h)(i), Table 3, substituted by regulation 6(e) of Notice No. 297, GG 40002, dated 20 May 2016]

| (ii) | [Regulation 23 (6)(h)(ii) deleted by section 2(b) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022] |

Table 4

Nature of exposure |

Credit conversion factor |

Most senior position in an unrated structure |

Refer to subparagraph (iii) below |

Any unrated second loss position provided by a bank that acts as a sponsor in respect of an ABCP programme |

Refer to subparagraph (iv) below |

First-loss credit enhancement facilities |

Refer to subparagraph (v) below |

Second-loss credit enhancement facilities |

Refer to subparagraph (vi) below |

Eligible liquidity facilities |

Refer to subparagraph (vii) below |

Eligible servicer cash advance facilities |

Refer to subparagraph (viii) below |

Facilities that overlap |

Refer to subparagraph (ix) below |

Securitisation of revolving facilities with early amortisation features |

Refer to subparagraph (xi) below |

Any other rated exposure |

100 per cent |

Other exposures |

100 per cent |

| (iii) | In the case of a senior securitisation exposure— |

| (A) | a bank may apply a “look-through” approach to a senior securitisation exposure, whereby the senior securitisation exposure could receive a maximum risk weight equal to the exposure weighted-average risk weight applicable to the underlying exposures, provided that— |

| (i) | the bank has knowledge of the composition of the underlying exposures at all times; |

| (ii) | the applicable risk weight under the IRB framework would be calculated inclusive of the expected loss portion multiplied by 12.5; |

| (iii) | where the bank uses exclusively the SA or the IRB approach, the risk weight cap for senior exposures would equal the exposure weighted-average risk weight that would apply to the underlying exposures under the SA or IRB framework, respectively; |

| (iv) | in the case of mixed pools, when applying the SEC-IRBA, the SA part of the underlying pool would receive the corresponding SA risk weight, while the IRB portion would receive IRB risk weights; when applying the SEC-SA or the SEC-ERBA, the risk weight cap for senior exposures would be based on the SA exposure weighted-average risk weight of the underlying assets, whether or not they are originally IRB; |

| (v) | where the risk weight cap results in a lower risk weight than the floor risk weight of 15%, the risk weight resulting from the cap must be used. |

| (B) | For purposes of sub-paragraph (A) a securitisation exposure is considered to be a senior exposure, and consequently the senior tranche, if it is effectively backed or secured by a first claim on the entire amount of the assets in the underlying securitisation pool (and does not include other claims that in a technical sense may be more senior in the waterfall such as a swap claim), |

Provided that:

| (i) | if a senior tranche is retranched or partially hedged, that is not on a pro rata basis, only the new senior part would be treated as senior for capital purposes; |

| (ii) | different maturities of several senior tranches that share pro rata loss allocation and therefore benefit from the same level of credit enhancement, shall have no effect on the seniority of these tranches. |

For example,

| (i) | In a typical synthetic securitisation, an unrated tranche would be treated as a senior tranche, provided that all of the conditions for inferring a rating from a lower tranche that meets the definition of a senior tranche are fulfilled. |

| (ii) | In a traditional securitisation where all tranches above the first-loss piece are rated, the most highly rated position would be treated as a senior tranche. When there are several tranches that share the same rating, only the most senior tranche in the cash flow waterfall would be treated as senior (unless the only difference among them is the effective maturity). In addition, when the different ratings of several senior tranches only result from a difference in maturity, all of these tranches should be treated as a senior tranche. |

Usually, a liquidity facility supporting an ABCP programme would not be the most senior position within the programme; the commercial paper, which benefits from the liquidity support, typically would be the most senior position. However, a liquidity facility may be viewed as covering all losses on the underlying receivables pool that exceed the amount of over collateralisation/reserves provided by the seller and as being most senior if it is sized to cover all of the outstanding commercial paper and other senior debt supported by the pool, so that no cash flows from the underlying pool could be transferred to the other creditors until any liquidity draws were repaid in full. In such a case, the liquidity facility can be treated as a senior exposure. Otherwise, if these conditions are not satisfied, or if for other reasons the liquidity facility constitutes a mezzanine position in economic substance rather than a senior position in the underlying pool, the liquidity facility should be treated as a non-senior exposure.

[Regulation 23 (6)(h)(iii) substituted by section 2(c) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (iv) | [Regulation 23(6)(h)(iv) deleted by section 2(b) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022] |

| (v) | In the case of a first-loss credit enhancement facility the bank shall risk weight the relevant exposure amount in accordance with the relevant requirements specified in paragraph (j) below; |

| (vi) | [Regulation 23 (6)(h)(vi) deleted by section 2(b) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022] |

| (vii) | In the case of eligible liquidity facilities, that is, a facility that complies with the conditions specified in paragraph 7 of the exemption notice relating to securitisation schemes, a bank that acts as an originator shall in no case provide any liquidity facility in respect of the securitisation scheme in respect of which that bank acts as such an originator. |

[Regulation 23 (6)(h)(iv) substituted by section 2(d) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (A) | When a bank or another institution within a banking group of which such a bank is a member, acting as a servicing agent, a repackager or a sponsor in respect of a securitisation scheme or resecuritisation exposure, provides an eligible liquidity facility in respect of such a securitisation scheme, that is, a facility that complies with the conditions specified in paragraph 7 of the exemption notice relating to securitisation schemes, the said bank or institution shall in the case of— |

| (i) | a facility with an external rating apply to the said position a credit-conversion factor of 100 per cent and the risk weight relating to the specific rating, as specified in subparagraph (i) above; |

| (ii) | a facility other than a facility with an external rating, irrespective of the maturity of the facility, apply a credit-conversion factor of 50 per cent in respect of the said eligible liquidity facility, which credit-conversion factor shall be applied to the highest risk weight assigned to any of the underlying individual exposures covered by the liquidity facility. |

[Regulation 23(6)(h)(vii)(A) substituted by regulation 2(c) of Notice No. R. 261, GG 38616, dated 27 March 2015]

| (B) | When a bank that provides a liquidity facility in respect of a traditional or synthetic securitisation scheme does not comply with the conditions specified in this subparagraph (vii) and the conditions specified in paragraph 7 of the exemption notice relating to securitisation schemes, the liquidity facility concerned— |

| (i) | shall be regarded as a first-loss credit-enhancement facility provided to the scheme by the aforementioned bank; and |

| (ii) | shall be risk weighted in accordance with the relevant requirements specified in subparagraph (v) above, |

provided that the aggregate amount of capital maintained by the said bank in terms of this item (B) shall be limited to the amount of capital that the bank would have been required to maintain in respect of all the assets or credit risk inherent in the assets transferred to the special-purpose institution in terms of the securitisation scheme if the said assets or credit risk inherent in the assets were actually held on the balance sheet of the bank that provided the said liquidity facility.

| (viii) | [Regulation 23 (6)(h)(viii) deleted by section 2(b) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022] |

(ix) For calculating the capital requirement for overlapping exposures—

| (A) | the bank’s exposure A overlaps another exposure B if in all circumstances the bank will preclude any loss for the bank on exposure B by fulfilling its obligations with respect to exposure A. |

For example, if a bank provides full credit support to some notes and holds a portion of these notes, its full credit support obligation precludes any loss from its exposure to the notes. If a bank can verify that fulfilling its obligations with respect to exposure A will preclude a loss from its exposure to B under any circumstance, the bank does not need to calculate risk-weighted assets for its exposure to B.

| (B) | To determine the overlap, a bank may, for the purposes of calculating capital requirements, split or expand its exposures, that is— |

| (i) | splitting exposures into portions that overlap with another exposure held by the bank and other portions that do not overlap; and |

| (ii) | expanding exposures by assuming for capital purposes that obligations with respect to one of the overlapping exposures are larger than those established contractually. This could be done, for instance, by expanding either the trigger events to exercise the facility and/or the extent of the obligation. |

For example, a liquidity facility may not be contractually required to cover defaulted assets or may not fund an ABCP programme in certain circumstances. For capital purposes, such a situation would not be regarded as an overlap to the notes issued by that ABCP conduit. However, the bank may calculate risk-weighted assets for the liquidity facility as if it were expanded (either in order to cover defaulted assets or in terms of trigger events) to preclude all losses on the notes. In such a case, the bank would only need to calculate capital requirements on the liquidity facility.

| (C) | An overlap could also be recognised between relevant capital charges for exposures in the trading book and capital charges for exposures in the banking book, provided that the bank is able to calculate and compare the capital charges for the relevant exposures ; |

[Regulation 23 (6)(h)(ix) substituted by section 2(e) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (xi) | In case of securitisation transactions containing early amortisation provisions: |

| (A) | Where the securitisation transaction contains one of the following examples as set out in subparagraphs (i) to (iv) below and meets the conditions specified in paragraph 4 for traditional securitisations and paragraph 5 for synthetic securitisations of the exemption notice for securitisation schemes, an originating bank may exclude the underlying exposures associated with such a transaction from the calculation of risk weighted exposure, but must still hold regulatory capital against any securitisation exposures they retain in connection with the transaction: |

| (i) | a replenishment structure, in terms of which structure the underlying exposures are not of a revolving nature and the early amortisation terminates the ability of the bank to transfer any further exposures; |

| (ii) | a transaction in respect of revolving assets, which transaction contains early amortisation features that mimic a term structure, that is, the risk relating to the underlying facilities does not return to the originator and where the early amortisation provision in a securitisation of revolving credit facilities does not effectively result in subordination of the originator’s interest; |

| (iii) | a structure in terms of which the bank securitised one or more revolving credit facilities but the investors remain fully exposed to any future draws by the borrowers, even after an early amortisation event has occurred; or |

| (iv) | the early amortisation provision is solely triggered by events unrelated to the performance of the underlying assets or the bank that transferred the assets, such as material changes in tax laws or regulations. |

| (B) | A securitisation transaction is deemed not to meet the conditions specified in paragraph 4 for traditional securitisations and paragraph 5 for synthetic securitisations of the exemption notice for securitisation schemes if— |

| (i) | a bank acts as an originator or sponsor to a securitisation transaction that includes one or more revolving credit facilities; and |

| (ii) | the securitisation transaction incorporates an early amortisation or similar provision that, if triggered, would— |

| (aa) | subordinate the bank’s senior or pari passu interest in the underlying revolving credit facilities to the interest of other investors; |

| (bb) | subordinate the bank’s subordinated interest to an even greater degree relative to the interests of other parties; or |

| (cc) | in other ways increases the bank’s exposure to losses associated with the underlying revolving credit facilities. |

[Regulation 23(6)(h)(xi) substituted by section 2(f) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (xii) | The maximum capital requirements for a securitisation exposure is as follows: |

| (A) | A bank (acting as an originator, sponsor or investor) using the SEC-IRBA for a securitisation exposure may apply a maximum capital requirement for the securitisation exposures it holds equal to the IRB capital requirement (including the expected loss portion) that would have been assessed against the underlying exposures had they not been securitised and treated under the appropriate sections of the IRB framework as well as subregulations 23(21) and (22); |

| (B) | An originating or sponsor bank using the SEC-ERBA or SEC-SA for a securitisation exposure may apply a maximum capital requirement for the securitisation exposures it holds equal to the capital requirement that would have been assessed against the underlying exposures had they not been securitised; |

| (C) | In the case of mixed pools, the maximum capital requirement should also be calculated by adding up the capital before securitisation; that is, by adding up the capital required under the general credit risk framework for the IRB and the SA part of the underlying pool, respectively. The IRB part of the capital requirement includes the expected loss portion; |

| (D) | Notwithstanding the approach adopted by the bank to calculate its capital requirements for a securitisation exposure, a bank will need the following inputs in order to apply a maximum capital charge to a bank’s securitisation exposure: |

| (i) | The largest proportion of interest that the bank holds for each tranche of a given pool (P). In particular: |

| (aa) | For a bank that has one or more securitisation exposure(s) that reside in a single tranche of a given pool, P equals the proportion (expressed as a percentage) of securitisation exposure(s) that the bank holds in that given tranche (calculated as the total nominal amount of the bank’s securitisation exposure(s) in the tranche) divided by the nominal amount of the tranche. |

| (bb) | For a bank that has securitisation exposures that reside in different tranches of a given securitisation, P equals the maximum proportion of interest across tranches, where the proportion of interest for each of the different tranches should be calculated as described above. |

| (ii) | Capital charge for underlying pool (KP): |

| (aa) | For an IRB pool, KP equals KIRB as defined in subregulation (11)(k); |

| (bb) | For an SA pool, KP equals KSA as defined in subregulation (6)(h)(j)(l)(B); |

| (cc) | For a mixed pool, KP equals the exposure weighted average capital charge of the underlying pool using KSA for the proportion of the underlying pool for which the bank cannot calculate KIRB, and KIRB for the proportion of the underlying pool for which a bank can calculate KIRB. |

| (iii) | The maximum aggregated capital requirement for a bank’s securitisation exposures in the same transaction will be equal to KP * P. |

| (E) | In applying the maximum capital charge cap, the entire amount of any gain on sale and credit-enhancing interest-only strips arising from the securitisation transaction must be deducted in accordance with regulation 38(5)(a)(i)(F). |

[Regulation 23(6)(h)(xii) inserted by section 2(g) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

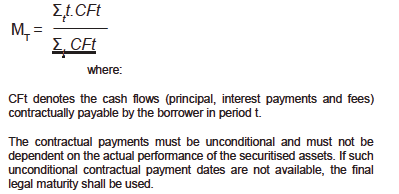

| (xiii) | Tranche maturity |

| (A) | For risk-based capital purposes as contemplated in the SEC-IRBA as set out in subregulation (11)(k) or the SEC-ERBA as set out in subregulation (6)(k), the tranche maturity (MT) is the tranche’s remaining effective maturity in years, with a floor of one year and a cap of five years provided that— |

| (i) | the tranche maturity can be measured at the bank's discretion in either of the following matters: |

| (aa) | As the rand-weighted-average maturity of the contractual cash flows of the tranche: |

| (bb) | On the basis of final legal maturity of the tranche, as: |

MT = (ML - 1) * 80%,

where:

ML is the final legal maturity of the tranche.

| (ii) | when determining the maturity of a securitisation exposure, banks must take into account the maximum period of time it will be exposed to potential losses from the securitised assets— |

| (aa) | in cases where a bank provides a commitment, the bank must calculate the maturity of the securitisation exposure resulting from this commitment as the sum of the contractual maturity of the commitment and the longest maturity of the asset(s) to which the bank would be exposed after a draw has occurred. If those assets are revolving, the longest contractually possible remaining maturity of the asset that might be added during the revolving period would apply, rather than the (longest) maturity of the assets currently in the pool; |

| (bb) | in cases where risk of the commitment/protection provider is not limited to losses realised until the maturity of that instrument (e.g. total return swaps), the same treatment applies as per subparagraph (aa) above; |

| (cc) | in cases where the credit protection instruments are only exposed to losses that occur up to the maturity of that instrument, a bank may apply the contractual maturity of the instrument and would not be required to look through to the protected position. |

[Regulation 23(6)(h)(xiii) inserted by section 2(h) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (i) | In the case of all unsettled securities or derivative contracts subject to counterparty risk, in accordance with the relevant provisions specified in subregulations (15) to (19) below. |

| (j) | In the case of all other exposures, in accordance with the relevant requirements specified in table 7 below: |

Table 7

Risk weight |

Transactions with the following counterparties, including assets |

||||||||

0% |

Transactions with the following counterparties

Central government of the RSA, provided that the relevant exposure is repayable and funded in Rand

Reserve Bank, provided that the relevant exposure is repayable and funded in Rand

Corporation for Public Deposits, provided that the relevant exposure is repayable and funded in Rand

Bank for International Settlements (BIS)

International Monetary Fund (IMF)

European Central Bank (ECB)

European Stability Mechanism (ESM)

European Financial Stability Facility (EFSF)

World Bank Group, including the International Bank for Reconstruction and Development (IBRD) and the International Finance Corporation (IFC)

Multilateral Investment Guarantee Agency (MIGA) [Inserted by section 3(c) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

International Development Association (IDA) [Inserted by section 3(c) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

Asian Development Bank (ADB)

African Development Bank (AfDB)

European Bank for Reconstruction and Development (EBRD)

Inter-American Development Bank (IADB)

European Investment Bank (EIB)

European Investment Fund (EIF)

Nordic Investment Bank (NIB)

Caribbean Development Bank (CDB)

Islamic Development Bank (IDB)

Council of Europe Development Bank (CEDB)

International Finance Facility for Immunization (IFFIm) [Inserted by section 3(d) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

Asian Infrastructure Investment Bank (AIIB) [Inserted by section 3(d) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

Intragroup bank balances 1

Intragroup balances with other formally regulated financial entities with capital requirements similar to these Regulations 1

Intragroup balances with branches of foreign banks

Assets

Cash and cash equivalents such as gold bullion |

||||||||

|

|||||||||

20% |

Transactions with the following counterparties

RSA public-sector bodies, excluding exposures to the central government, SA Reserve Bank and the Corporation for Public Deposits when the said exposure is repayable and funded in Rand

Banks in the RSA, provided that the claim on the bank has an original maturity of three months or less and is denominated and funded in Rand, excluding any claim on a RSA bank that is renewed or rolled resulting in an effective maturity of more than three months [Substituted by regulation 2(d) of Notice No. R. 261 dated 27 March 2015]

A securities firm in the RSA, provided that such a firm is subject to comparable supervisory and regulatory arrangements than banks in the RSA, including, in particular, risk-based capital requirements and regulation and supervision on a consolidated basis and the claim on the securities firm has an original maturity of three months or less and is denominated and funded in Rand, excluding any claim on a securities firm in the RSA that is renewed or rolled resulting in an effective maturity of more than three months [Substituted by regulation 2(d) of Notice No. R. 261 dated 27 March 2015]

Assets

Cash items in process of collection |

||||||||

100% |

Transactions with the following counterparties or assets

An investment in a significant minority or majority owned or controlled commercial entity, which investment amounts to less than 15 per cent of the issued common equity tier 1 capital and reserve funds, additional tier 1 capital and reserve funds and tier 2 capital and reserve funds of the reporting bank, as reported in items 41, 65 and 78 of form BA 700

All other counterparties or assets not covered elsewhere in this paragraph (j) |

||||||||

150% or higher 1 |

Assets Such assets as may be specified in writing by the Authority [Substituted by section 3(e) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021] |

||||||||

1250% |

Transactions with the following counterparties, including assets A first-loss position, including a credit enhancement facility in respect of a securitisation or resecuritisation scheme

A materiality threshold specified in a guarantee or creditderivative contract, which materiality threshold either reduces the amount of payment or requires a given amount of loss to occur for the account of the protection buyer before the protection seller is obliged to make payment to the said protection buyer

The excess amount relating to a significant investment, that is, a shareholding of 20 per cent or more, in a commercial entity, which investment is equal to or exceeds 15 per cent of the issued common equity tier 1 capital and reserve funds, additional tier 1 capital and reserve funds and tier 2 capital and reserve funds of the reporting bank, as reported in items 41, 65 and 78 of the form BA 700

The relevant excess amount when the aggregate amount of significant investments, that is, a shareholding of 20 per cent or more, in commercial entities, exceeds 60 per cent of the sum of the issued common equity tier 1 capital and reserve funds, additional tier 1 capital and reserve funds and tier 2 capital and reserve funds of the reporting bank, as reported in items 41, 65 and 78 of the form BA 700

Credit protection provided, which credit protection has a long-term rating of B+ or below or a short-term rating other than A-1/P-1, A-2/P-2 or A-3/P-3

Any unrated position in a rated structure relating to credit protection provided in terms of a credit-derivative instrument

In the case of a synthetic securitisation scheme, any retained position that is unrated or rated below investment grade

The net amount, that is, the amount after any specific credit impairment or provision, and any deduction directly against common equity tier 1 or additional tier 1 capital and reserve funds, have been taken into account, in respect of any credit enhancing interest-only strip relating to a securitisation transaction |

||||||||

|

|||||||||

[Regulation 23(6)(j), Table 7, substituted by section 3(c), (d) and (e) of Notice No. 1427, GG44048, dated 31 December 2020 - effective 1 January 2021]

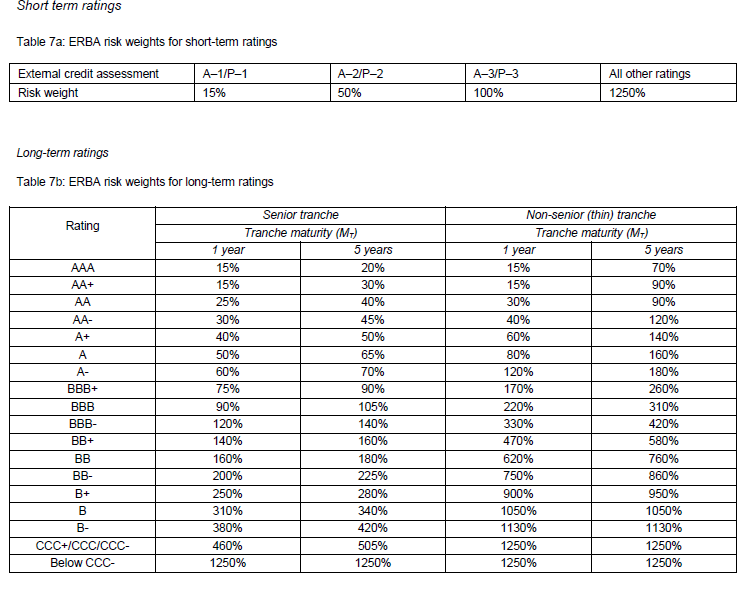

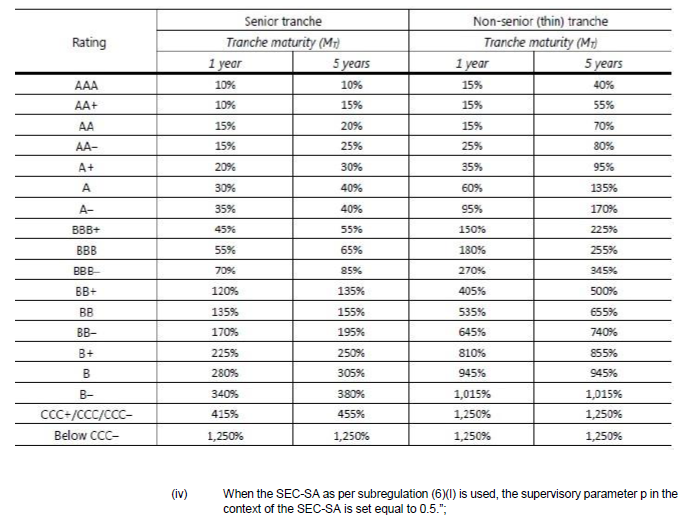

SEC-ERBA

| (k) | For securitisation exposures that are externally rated, or for which an inferred rating is available, and provided that the operational requirements as contemplated in regulation 38(6) and subregulation (xv) below are satisfied, the risk-weighted assets under the SEC-ERBA must be determined by multiplying securitisation exposure amounts as contemplated in subregulation 6(h)(i)(F) above by the appropriate risk weights as determined below: |

| (i) | in the case of an exposure with an external short-term credit rating, or when an inferred rating based on an external short-term credit rating is available, use the risk weights specified in Table 7(a) below; |

| (ii) | in the case of an exposure with an external long-term credit rating, or when an inferred rating based on an external long-term credit rating is available use the risk weights specified in Table 7(b), where the risk weights depend on: |

| (A) | the external rating grade or an available inferred rating; |

| (B) | the seniority of the position; |

| (C) | the tranche maturity as calculated in terms of subregulation (6)(h)(xiii) and using linear interpolation between the risk weight for one and five years; and |

| (D) | the tranche thickness for non-senior tranches, as calculated in terms of subparagraph (iii) below |

| (iii) | To account for tranche thickness, banks shall calculate the risk weight for non-senior tranches as follows: |

Risk weight = [risk weight from table 7b after adjusting for maturity] * [1 – min(T; 50%)],

where T equals tranche thickness, and is measured as the tranche detachment point D minus the tranche attachment point A, as defined respectively, in subregulation (23)(6)(j) and 23(6)(m).

| (iv) | In the case of market risk hedges such as currency or interest rate swaps, the risk weight will be inferred from a securitisation exposure that is pari passu to the swaps or, if such an exposure does not exist, from the next subordinated tranche. |

| (v) | The resulting risk weight is subject to a floor risk weight of 15%. In addition, the resulting risk weight should never be lower than the risk weight corresponding to a senior tranche of the same securitisation with the same rating and maturity. |

| (vi) | In accordance with the hierarchy of approaches as determined in accordance with subregulation (6)(h)(i)(A), a bank may infer a rating for an unrated position and use the SEC-ERBA provided that the following requirements are met— |

| (A) | the reference securitisation exposure shall in all respects rank pari passu or be subordinated to the relevant unrated securitisation exposure; |

| (B) | the bank shall take into account any relevant credit enhancement when the bank assesses the relative subordination of the unrated exposure in relation to the reference secur itisation exposure. For example, when the reference securitisation exposure benefits from any third-party guarantee or other credit enhancement, which protection is not available to the unrated exposure, the bank shall not assign an inferred rating to the said unrated exposure; |

| (C) | the maturity of the reference securitisation exposure shall be equal to or longer than the maturity of the relevant unrated exposure; |

| (D) | on a continuous basis, the bank shall update any inferred rating in order to reflect any subordination of the unrated position or changes in the external rating of the reference securitisation exposure; and |

| (E) | the external rating of the reference securitisation exposure shall comply with the relevant requirements for recognition of external ratings specified in regulation 38(6) of these Regulations. |

[Regulation 23(6)(k) inserted by section 2(i) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

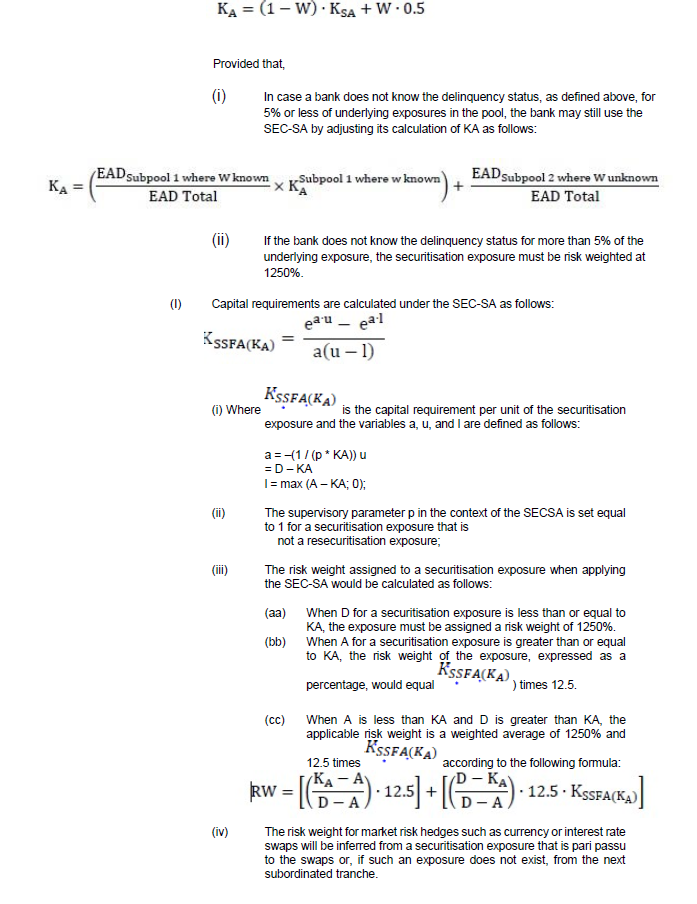

SEC-SA

| (l) | When a bank cannot use the SEC-IRBA or the SEC-ERBA, it must use the SEC-SA in order to calculate capital requirements for a securitisation exposure to a SA pool in accordance with the relevant requirements specified below: |

| (A) | In order to use the SEC-SA a bank would use a supervisory formula and the following bank-supplied inputs: |

| (i) | the SA capital charge had the underlying exposures not been securitised (KSA); |

| (ii) | the ratio of delinquent underlying exposures to total underlying exposures in the securitisation pool (W) as defined in subparagraph (F) below; and |

| (iii) | the tranche attachment point A and tranche detachment point D as defined in subregulation (23)(11) provided that where the only difference between exposures to a transaction is related to maturity, A and D will be the same. |

| (B) | KSA is the weighted-average capital charge of the entire portfolio of underlying exposures expressed as a decimal between zero and one and determined using the risk-weighted exposure amounts calculated in accordance with regulation 23(8) and (9), multiplied by 8%. KSA should reflect the effects of any credit risk mitigant that is applied to the underlying exposures (either individually or to the entire pool), and hence benefits all of the securitisation exposures; |

| (C) | the case of a structure involving a special-purpose entity (SPE), all of the SPE’s exposures related to the securitisation are to be treated as exposures in the pool. Exposures related to the securitisation that should be treated as exposures in the pool include assets in which the SPE may have invested, comprising reserve accounts, cash collateral accounts and claims against counterparties resulting from interest swaps or currency swaps. Notwithstanding, the bank can exclude the SPE’s exposures from the pool for capital calculation purposes if the bank can demonstrate to the Authority that the risk does not affect its particular securitisation exposure or that the risk is immaterial – for example, because it has been mitigated; |

| (D) | In the case of funded synthetic securitisations, any proceeds of the issuances of credit-linked notes or other funded obligations of the SPE that serve as collateral for the repayment of the securitisation exposure in question, and for which the bank cannot demonstrate to the Authority that they are immaterial, have to be included in the calculation of KSA if the default risk of the collateral is subject to the tranched loss allocation. |

| (E) | In cases where a bank has set aside a specific provision or has a non-refundable purchase price discount on an exposure in the pool, KSA must be calculated using the gross amount of the exposure without the specific provision and/or non-refundable purchase price discount. |

| (F) | The variable W equals the ratio of the sum of the nominal amount of delinquent underlying exposures (as defined in subparagraph (G) below) divided by the nominal amount of underlying exposures. |

(G) Delinquent underlying exposures are underlying exposures that are –

(i) 90 days or more past due;

(ii) subject to bankruptcy or insolvency proceedings;

(iii) in the process of foreclosure;

(iv) held as real estate owned; or

(v) in default, where default is defined within the securitisation deal documents.

(H) The inputs KSA and W are used as inputs to calculate KA, as follows:

| (v) | The resulting risk weight is subject to a floor risk weight of 15%. Moreover, when a bank applies the SEC-SA to an unrated junior exposure in a transaction where the more senior tranches (exposures) are rated and therefore no rating can be inferred for the junior exposure, the resulting risk weight under SEC-SA for the junior unrated exposure shall not be lower than the risk weight for the next more senior rated exposure. |

[Regulation 23(6)(l) inserted by section 2(j) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (m) | Treatment of resecuritisation exposures: |

| (i) | For resecuritisation exposures, banks must apply the SEC-SA specified in paragraphs subregulation (6)(h) and (l), with the following adjustments: |

| (A) | the capital requirement of the underlying securitisation exposures is calculated using the securitisation framework; |

| (B) | delinquencies (W) are set to zero for any exposure to a securitisation tranche in the underlying pool; and |

| (C) | the supervisory parameter p is set equal to 1.5, rather than 1 as for securitisation exposures. |

| (ii) | If the underlying portfolio of a resecuritisation consists in a pool of exposures to securitisation tranches and to other assets, the bank should separate the exposures to securitisation tranches from exposures to assets that are not securitisations and the KA parameter - |

| (A) | should be calculated for each subset individually, applying separate W parameters calculated in accordance with subregulations (6)(h)(j)(l)(F) and (G) in the subsets where the exposures are to assets that are not securitisation tranches, and |

| (B) | is set to zero where the exposures are to securitisation tranches. |

| (C) | is the nominal exposure weighted-average of the KA’s for each subset considered. |

| (iii) | The resulting risk weight is subject to a floor risk weight of 100%. |

| (iv) | The caps described in paragraphs subregulations (6)(h)(iii) and (xii) cannot be applied to resecuritisation exposures. |

[Regulation 23(6)(m) inserted by section 2(k) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

| (n) | For purposes of this paragraph— |

| (i) | a simple, transparent and comparable securitisation (STC) means a securitisation that meets the definition of a STC as may be specified in writing by the Authority; |

| (ii) | exposures to non-asset-backed commercial paper programme (ABCP), traditional securitisations that meet the criteria for STC securitisations as specified in writing by the Authority will be considered STC-compliant; |

| (iii) | exposures to ABCP conduits and/ or transactions financed by ABCP conduits where the conduit and/or transactions financed by it meet the short-term STC criteria as specified in writing by the Authority, will be considered STC-compliant; |

| (iv) | exposures to true-sale securitisations that are assessed as STC compliant for capital purposes shall be subject to the capital requirements specified below, provided that— |

| (A) | when the SEC-IRBA is used, subregulation (6)(o)(i) below is applicable; |

| (B) | when SEC-ERBA is used, subregulation (6)(o)(ii) below is applicable; |

| (C) | when SEC-SA is used, subregulation (6)(o)(iv) below is applicable; |

| (D) | under all three approaches as contemplated in subparagraph (i), (ii) and (iii) above, the resultant risk weight is subject to a floor risk weight of 10% for senior tranches and 15% for non-senior tranches. |

[Regulation 23(6)(n) inserted by section 2(l) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]

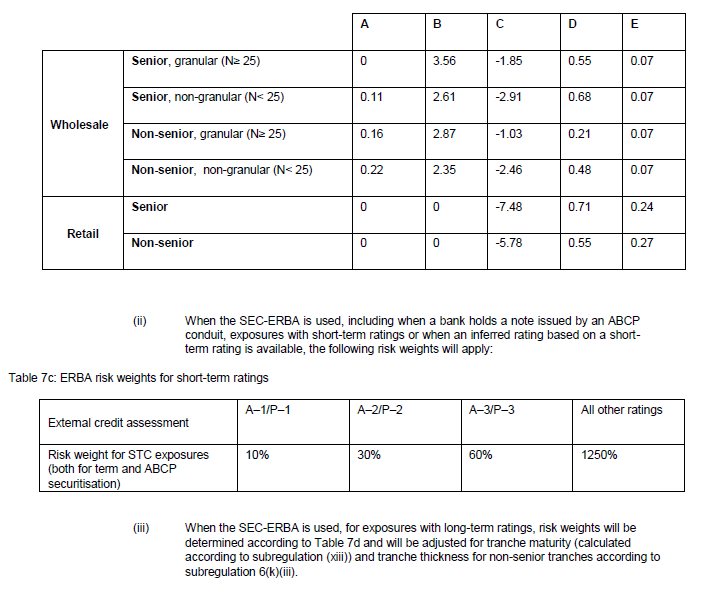

| (o) | Securitisation transactions that are assessed as STC-compliant for capital purposes, that is, the STC criteria as specified in writing by the Authority was met, shall be subject to the following capital requirements: |

| (i) | When SEC-IRBA as per regulation 23(11)(k) is used, supervisory parameter p in SEC-IRBA will be determined as follows: |

p=max [0.3; (A + B*(1/N) + C*KIRB + D*LGD +E*MT)*0.5]

where:

0.3 denotes the p-parameter floor;

| N | is the effective number of loans in the underlying pool calculated as described in subregulation 11(n) below; |

| KIRB | is the capital charge of the underlying pool (as defined in subregulation 11(k)(i); |

| LGD | is the exposure-weighted average loss-given default of the underlying pool, calculated as described in subregulation (11)(o) below; |

| MT | is the maturity of the tranche calculated according to subregulation (6)(h)(xiii); and the parameters A, B, C, D, and E are determined according to the following look-up table: |

[Regulation 23(6)(o) inserted by section 2(m) of Notice No. 2561, GG46996, dated 30 September 2022 - effective 1 October 2022]