Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof26. Liquidity riskDirectives, definitions and interpretations for completion of monthly return concerning liquidity risk (Form BA 300)Subregulation (14) Matters related to the calculation of a bank's net stable funding ratio |

| (14) | Matters related to the calculation of a bank's net stable funding ratio |

| (a) | Specified minimum requirements |

In order to promote a bank’s funding stability and resilience over a one year time horizon and ensure that the bank continuously maintains a minimum specified amount of stable sources of funding relative to the liquidity profile of the bank’s assets and the potential for contingent liquidity needs arising from the bank’s off-balance sheet commitments, and in order to mitigate a bank’s potential over-reliance on short-term wholesale funding, a bank shall calculate and on an ongoing basis maintain a Net Stable Funding Ratio (NSFR) in accordance with, and comply with, the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, provided that—

| (i) | the bank’s NSFR, calculated in accordance with the relevant requirements specified in this subregulation (14), and in particular, in accordance with the formula specified in paragraph (d) below, shall on an ongoing basis be equal to or higher than 100%; |

| (ii) | in all relevant cases, the requirements specified in this subregulation (14) shall apply on a solo and consolidated basis, provided that— |

| (A) | notwithstanding the obligation to also calculate and maintain a NSFR on a consolidated basis, the bank and controlling company shall actively monitor and control the liquidity risk exposures and funding needs at the level of each relevant individual legal entity, foreign branch and subsidiary, and any relevant sub-group or group as a whole, taking into account legal, regulatory and operational limitations in respect of the transferability of liquidity; |

| (B) | subject to the prior written approval of and such conditions as may be specified in writing by the Authority, in the case of consolidation or solo reporting of relevant entities, a bank may apply the rules or regulations of relevant host supervisors in respect of the treatment of retail or small business deposits of relevant entities operating in those jurisdictions; |

| (iii) | for purposes of this subregulation (14)— |

| (A) | the relevant available amount of stable funding is deemed to be a function of, among other things, the relative stability of the bank’s funding sources, including the contractual maturity of its liabilities; |

| (B) | stable funding means the portion of those types and amounts of equity and liabilities expected to be reliable sources of funds over a one-year time horizon; |

| (C) | when the bank wishes to determine the maturity of any relevant equity or liability item or instrument, the bank shall assume that investors will redeem a call option at the earliest possible date; |

| (D) | when the market expects certain liabilities to be redeemed before their legal final maturity date, the bank shall assume such behaviour when it calculates its relevant required NSFR, and include such liabilities in the corresponding available stable funding (ASF) category; |

| (E) | in the case of long-dated liabilities, the bank shall ensure that only the portion of cash flows falling at or beyond the six-month and one-year time horizons, respectively, is treated as having an effective residual maturity of six months or more and one year or more, as the case may be; |

| (F) | the relevant required amount of funding shall be deemed to be a function of the liquidity characteristics and residual maturities of various types of assets held by the bank, the bank’s off-balance-sheet contingent exposures and/or the activities pursued by the bank; |

| (G) | in order not to create an environment in which banks rely on the Reserve Bank or another relevant central bank as a source of funding, any extended borrowing from central bank lending facilities, outside regular open market operations, falls outside the scope of this subregulation (14) and the calculation of the NSFR; |

| (H) | unless specifically otherwise stated in this subregulation (14) or directed in writing by the Authority, the respective definitions applicable to the bank’s calculation of LCR in terms of the provisions of subregulation (12) shall mutatis mutandis apply to the calculation of the bank’s NSFR in terms of the provisions of this subregulation (14). |

| (b) | Matters related to the calculation of a bank’s amount of ASF |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall continuously calculate its relevant amount of ASF, provided that—

| (i) | in the case of items other than derivative liabilities, the bank shall calculate its relevant required ASF amount— |

| (A) | by first assigning to the relevant category or categories of equity and liability items specified in table 1 below, or such additional category or categories of equity or liability items as may be specified in writing by the Authority, the respective carrying values of the bank’s respective equity or liability items, that is, the relevant amounts at which the respective equity or liability items or instruments are reflected in the bank’s accounting records, before the application of any regulatory deduction, filter or other adjustment; and then |

| (B) | multiply the relevant assigned carrying amounts with the relevant ASF factors specified in table 1 below or such further ASF factor as may be specified in writing by the Authority; and then |

| (C) | determine the bank’s relevant total ASF amount, which amount shall be equal to the relevant sum of the respective calculated weighted amounts: |

Table 1

Description of item |

ASF factor |

||||||||||

Liabilities and capital instruments assigned a ASF factor of 100% |

|||||||||||

|

100% |

||||||||||

Liabilities assigned a ASF factor of 95% |

|

||||||||||

|

95% |

||||||||||

Liabilities assigned a ASF factor of 90% |

|

||||||||||

|

90% |

||||||||||

Liabilities assigned a ASF factor of 50% |

|

||||||||||

|

50% |

||||||||||

Liabilities assigned a ASF factor specified in writing by the Authority |

|

||||||||||

and which deposits comply with such further requirements as may be specified in writing by the Authority

|

As may be specified in writing by the Authority |

||||||||||

Liabilities assigned a ASF factor of 0% |

|

||||||||||

|

0% |

| 1. | Any cash flows falling below the one-year horizon but arising from liabilities with a final maturity greater than one year must be excluded from the 100% ASF factor category. |

| 2. | As defined in subregulation (12) above for the calculation of the bank’s LCR. |

| 3. | As defined in subregulation (12) above for the calculation of the bank’s LCR. |

| 4. | As defined in subregulation (12) above for the calculation of the bank’s LCR. |

| 5. | The bank shall treat any deferred tax liability according to the nearest possible date on which such liability could be realised, that is, the bank shall assign to the relevant amount a 100% ASF factor when the effective maturity is one year or more, or 50% when the effective maturity is between six months and less than one year. |

| 6. | The bank shall treat any relevant amount related to a minority interest according to the term of the relevant instrument, which is usually in perpetuity, that is, the bank shall assign to the relevant amount a 100% ASF factor when the effective maturity is one year or more, or 50% when the effective maturity is between six months and less than one year. |

| (ii) | in the case of derivative liabilities— |

| (A) | the bank shall firstly calculate the relevant replacement cost for all its relevant derivative contracts by marking the said derivative contract or instrument to market where the contract or instrument has a negative value, provided that— |

| (i) | when the bank has in place an eligible bilateral netting contract that complies with the relevant requirements specified in regulation 23(17)(b), the replacement cost for the relevant set of derivative exposures covered by the contract shall be the relevant net replacement cost amount; |

| (ii) | when the bank calculates the relevant derivative liability amount the bank shall deduct from the relevant negative replacement cost amount any relevant amount related to collateral posted in the form of variation margin in connection with the said derivative contracts, regardless of the asset type; |

| (iii) | in order to avoid the potential risk of double-counting, when the bank reflects as an on-balance-sheet item an asset associated with collateral posted as variation margin in relation to a derivative contract that is deducted from the replacement cost amount, as envisaged herein before, the bank shall not include that asset in the calculation of the bank’s relevant amount of required stable funding (RSF); |

| (B) | the bank shall then finally assign to the relevant derivative liability amount an ASF factor of 0%, that is: |

ASF = 0% x Max((NSFR derivative liabilities – NSFR derivative assets), 0).

| (c) | Matters related to the calculation of a bank’s required amount of stable funding |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall continuously calculate its relevant amount of required stable funding, that is, RSF, provided that—

| (i) | in all relevant cases, unless specifically otherwise stated in this subregulation (14)(c)— |

| (A) | the bank shall allocate the relevant amount of an asset or item to the appropriate RSF factor based on the relevant asset or item’s residual maturity or liquidity value; |

| (B) | when the bank wishes to determine the maturity of an asset or instrument, the bank shall assume that investors will exercise any option to extend maturity; |

| (C) | when the bank determined that the market expects the bank to extend the maturity of an asset, the bank shall assume such behaviour, and include the asset in the relevant corresponding RSF category; |

| (D) | the bank— |

| (i) | shall include all relevant financial instruments, foreign currencies and commodities in respect of which a purchase order has been executed, and |

| (ii) | shall exclude all relevant financial instruments, foreign currencies and commodities in respect of which a sales order has been executed, |

even when such transactions have not been reflected in the bank’s balance sheet in terms of a settlement-date accounting model, provided that—

| (aa) | such transactions are not reflected as derivatives or secured financing transactions in the bank’s balance sheet, and |

| (bb) | the effects of such transactions will be reflected in the bank’s balance sheet when settled. |

| (ii) | in the case of any amortising loan, the bank may treat the portion of the loan that becomes due and payable within the one-year horizon in the less-than-one-year residual maturity category; |

| (iii) | in the case of interdependent assets and liabilities specified and approved in writing by the Authority, in respect of which— |

| (A) | the relevant contractual agreements and arrangements clearly determine that— |

| (i) | the liability cannot fall due while the asset remains on the bank’s balance sheet; |

| (ii) | the principal payment flows from the asset cannot be used for anything other than to repay the liability; and |

| (iii) | the liability cannot be used to fund any other asset, |

| (B) | the individual interdependent asset and liability items are clearly identifiable; |

| (C) | the maturity and principal amount of both the liability and its interdependent asset are the same; |

| (D) | the bank is acting solely as a pass-through unit to channel the funding received, that is, the interdependent liability, into the corresponding interdependent asset; and |

| (E) | the counterparties for each pair of interdependent liabilities and assets are not the same, |

the bank may apply a RSF factor and an ASF factor of 0% respectively;

| (iv) | in the case of items other than derivative assets, off-balance sheet exposures, potential liquidity exposures and interdependent assets and liabilities, the bank shall calculate its relevant required RSF amount— |

| (A) | by first assigning to the relevant category or categories of asset items specified in table 1 below, or such additional category or categories of asset items as may be specified in writing by the Authority, the relevant carrying value of the bank’s relevant assets; and then |

| (B) | multiply the relevant assigned carrying amounts with the relevant associated RSF factors specified in table 1 below or such further RSF factor as may be specified in writing by the Authority; and then |

| (C) | determine the bank’s relevant RSF amount related to items other than derivative assets, off-balance sheet exposures and potential liquidity exposures, which amount shall be equal to the relevant sum of the respective weighted amounts: |

Table 1

Description of item |

RSF factor |

||||||||||||||||||||||||

Assets assigned a RSF factor of 0% |

|||||||||||||||||||||||||

|

0% |

||||||||||||||||||||||||

Assets assigned a RSF factor specified in writing by the Authority |

|

||||||||||||||||||||||||

|

As may be specified in writing by the Authority |

||||||||||||||||||||||||

Assets assigned a RSF factor of 5% |

|

||||||||||||||||||||||||

|

5% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 10% |

|

||||||||||||||||||||||||

|

10% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 15% |

|

||||||||||||||||||||||||

|

15% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 50% |

|

||||||||||||||||||||||||

|

50% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 65% |

|

||||||||||||||||||||||||

|

65% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 85% |

|

||||||||||||||||||||||||

|

85% |

||||||||||||||||||||||||

Assets assigned a RSF factor of 100% |

|

||||||||||||||||||||||||

|

100% |

||||||||||||||||||||||||

Other specified encumbered assets: |

|

||||||||||||||||||||||||

|

The same RSF factor as an equivalent asset that is unencumbered |

||||||||||||||||||||||||

|

50% |

||||||||||||||||||||||||

|

The relevant higher RSF factor |

| 1. | Securities financing transactions with a single counterparty may be measured on a net basis when the bank complies with the relevant requirements specified in regulation 38(15)(e) of these Regulations. |

| (v) | in the case of derivative assets— |

| (A) | the bank shall firstly calculate the replacement cost for all its relevant derivative contracts by marking the said derivative contract to market where the contract has a positive value, provided that— |

| (i) | when the bank has in place an eligible bilateral netting contract that complies with the relevant requirements specified in regulation 23(17)(b), the replacement cost for the relevant set of derivative exposures covered by the contract shall be the relevant net replacement cost amount; |

| (ii) | when the bank calculates the relevant NSFR derivative asset amount, the bank shall not offset collateral received in connection with the relevant derivative contract against the calculated positive replacement cost, unless it is received in the form of cash variation margin and complies with the relevant requirements specified in regulation 38(15)(e) of these Regulations, provided that any remaining balance sheet liability associated with— |

| (aa) | variation margin received that does not meet the said criteria; or |

| (bb) | initial margin received shall not offset the relevant derivative asset amount, |

and shall be assigned an ASF factor of 0%;

| (B) | the bank shall assign to the relevant— |

| (i) | derivative asset amount a RSF factor of 100%, that is: |

RSF = 100% x max((NSFR derivative assets – NSFR derivative liabilities), 0);

| (ii) | derivative liability amount an ASF factor of 0%. |

| (vi) | in the case of off-balance sheet and potential liquidity exposures, in order to ensure that the bank has sufficient stable funding in place for the relevant portion of an exposure that requires funding within a one-year horizon, the bank shall calculate its relevant RSF amount— |

| (A) | by first assigning the relevant exposure to the relevant category specified in table 2 below, or such additional category or categories of exposure items as may be specified in writing by the Authority; and then |

| (B) | multiply the relevant assigned exposure amount with the relevant associated RSF factor specified in table 2 below, or such further RSF factor as may be specified in writing by the Authority; and then |

| (C) | determine the bank’s relevant RSF amount related to off-balance sheet and potential liquidity exposures, which amount shall be equal to the relevant sum of the respective weighted amounts: |

Table 2

Description of exposure |

RSF factor |

||||||||||||||||

|

5% |

||||||||||||||||

|

As may be specified in writing by the Authority |

| (vii) | the bank’s relevant total RSF amount shall be equal to the relevant sum of the respective amounts determined in terms of the provisions of subparagraphs (i) to (vi) specified herein before. |

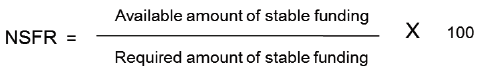

| (d) | Formula for the calculation of NSFR |

Based on the relevant requirements specified in this subregulation (14) read with such further conditions or requirements related to the NSFR as may be directed or specified in writing by the Authority, a bank shall calculate its NSFR in accordance with the formula specified below:

[Regulation 26(14) substituted by section 7(f) of Notice No. 724, GG44003, dated 18 December 2020]