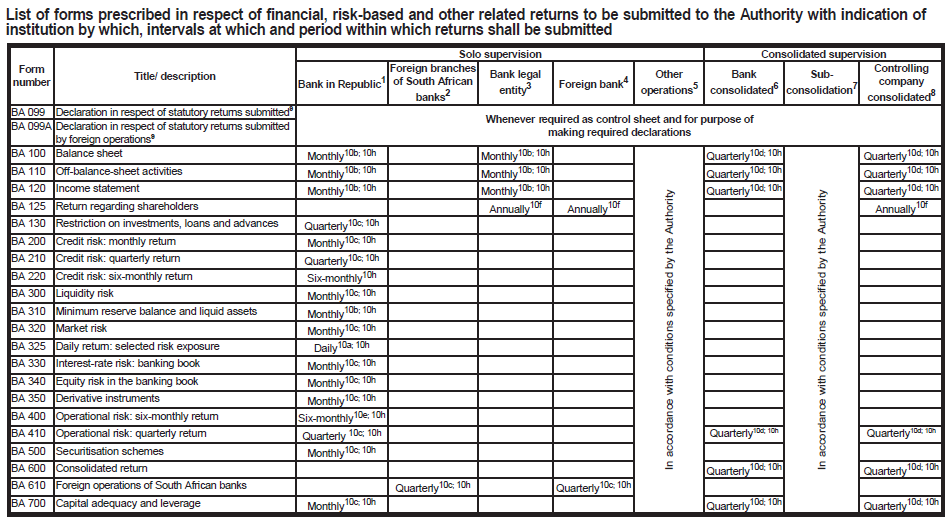

Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof7. List of forms prescribed in respect of financial, risk-based and other related returns to be submitted to the Registrar with indication of institution by which, intervals at which and period within which returns shall be submitted |

| 1 | Means the supervision of the South African operations of a bank incorporated in the Republic. |

| 2 | Means a bank conducting business as such outside the Republic, through the medium of a branch of a bank. |

| 3 | Means the supervision of a bank on a legal entity basis, that is, the combination of information of the relevant bank in the Republic and its relevant branches. |

| 4 | Means a bank or other entity conducting the business of a bank, which bank or entity is not located or incorporated in the Republic but is controlled by a bank or controlling company that is incorporated in the Republic, but does not include any branch of a bank. |

| 5 | Means any regulated or unregulated non-bank entity controlled by a bank or controlling company incorporated in the Republic. |

| 6 | Means the supervision on a consolidated basis of a bank incorporated in the Republic and its relevant branches, subsidiaries and associates, as envisaged in regulation 36. |

| 7 | Means the supervision on a sub-consolidated basis of a bank or controlling company and its relevant branches, subsidiaries and associates when the said bank or controlling company is a subsidiary of another bank or controlling company subject to the relevant requirements for consolidated supervision specified in these Regulations. |

| 8 | Means the supervision on a consolidated basis of a bank controlling company incorporated in the Republic and its relevant subsidiaries and associates, as envisaged in regulation 36. |

| 9 | Forms BA 099 and BA 099A are not prescribed financial returns, but shall be used as a control sheet and to furnish the required declarations regarding compliance and the maintenance of prescribed minimum balances. |

| 10 | The prescribed statements and returns shall be submitted within the periods specified below. |

| (a) | Before 09:00 am on the second business day immediately following on the day to which the prescribed statement or return relates. |

| (b) | Within 15 business days immediately following on the month-end or quarter-end to which the prescribed statement or return relates. |

| (c) | Within 20 business days immediately following on the month-end or quarter-end to which the prescribed statement or return relates. |

| (d) | Within 30 business days immediately following on the month-end or quarter-end to which the prescribed statement or return relates. |

| (e) | Within 20 business days immediately following on the sixth month of the financial year or the date to which the annual financial statements relate. |

| (f) | Within 30 days of 31 December of each year. |

| (g) | Within 90 days immediately following on the date to which the annual financial statements relate. |

| (h) | Within 60 days immediately following on the sixth month of the financial year and within 90 days immediately following on the date to which the annual financial statements relate. |

| (i) | Within 20 business days of 30 June and 31 December of each year. |

(Note: As an example, a reference to 10c; 10h in respect of a specific prescribed return means two independent submissions in respect of the specified return, interval and period.)

Form BA 099 - Declaration in respect of statutory returns submitted

Form BA 099A - Declaration in respect of statutory returns submitted by foreign operations

[Regulation 7 substituted by section 3 of Notice No. 724, GG44003, dated 18 December 2020 - effective 1 January 2021]