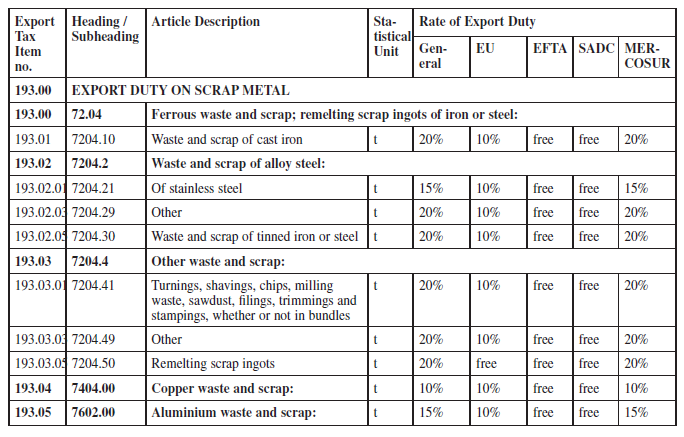

Customs and Excise Act, 1964 (Act No. 91 of 1964)SchedulesSchedule I : Rates of Normal TaxPart 6 : Export Duty |

NOTES:

| 1. | Whenever the tariff heading or subheading under which any goods are classified in Part 1 of this Schedule is expressly quoted in any export duty item of this Part in which such goods are specified, the goods so specified in such export duty item shall be deemed to include only goods which are classifiable under the said tariff heading or subheading. |

[Notes to Part 6 of Schedule 1 inserted by section 60(1)(a) of the Taxation Laws Amendment Act, 2020 (Act No. 23 of 2020), GG44083, dated 20 January 2021 - come into operation on 1 March 2021 (section 60(2)]

[Table to Part 6 of Schedule 1 inserted by section 60(1)(c) of the Taxation Laws Amendment Act, 2020 (Act No. 23 of 2020), GG44083, dated 20 January 2021 - come into operation on 1 March 2021 (section 60(2))]