Electricity Regulation Act, 2006 (Act No. 4 of 2006)NoticesIntegrated Resource Plan 20194. Input Parameter Assumptions4.1 Electricity Demand |

Electricity demand as projected in the promulgated IRP 2010–2030 did not materialise due to a number of factors which resulted in lower demand. These include, among others, lower economic growth; improved energy efficiency by large consumers to cushion against rising tariffs; fuel switching to liquefied petroleum gas (LPG) for cooking and heating; fuel switching for hot water heating by households; and the closing down or relocation to other countries of some of the energy intensive industry.

| 4.1.1 | Electricity Demand from 2010–2016 |

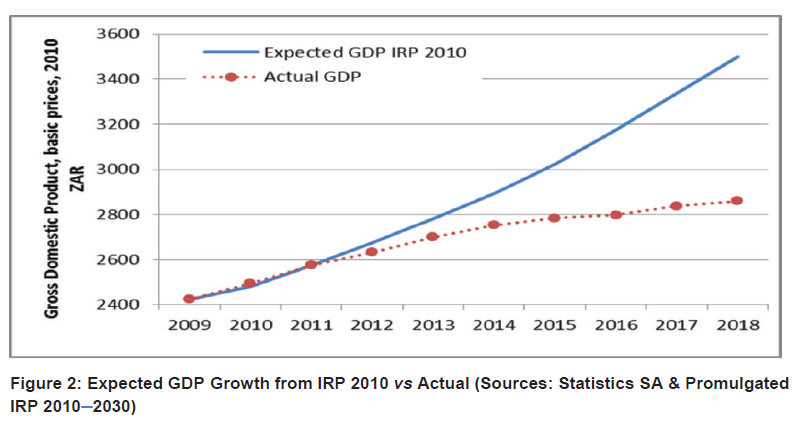

Reported Gross Domestic Product (GDP) for the period 2010–2016 was significantly lower than the GDP projections assumed in the promulgated IRP 2010–2030. This is depicted in Figure 2.

The compound average growth rate for the years 2010 to 2016 was 2,05%. This lower GDP growth compared with the expectations in 2010 had an impact on the resulting electricity demand as depicted in Figure 3.

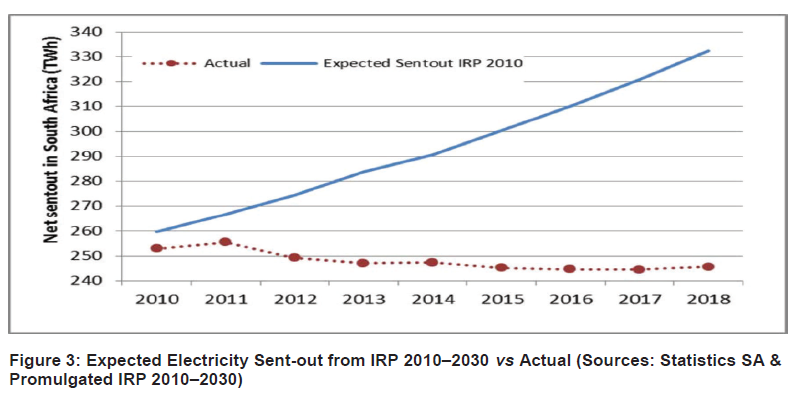

The actual net electricity energy sent-out for the country declined at an average compound rate of -0,6% over the past years. That was in stark contrast with the expectation of an average growth rate of 3,0% in the promulgated IRP 2010–2030. The result was that the actual net sent-out electricity in 2016 was at 244TWh in comparison with the expected 296TWh (18% difference).

The underlying causes of the reduced electricity demand were many-sided, including:

| ▪ | General economic conditions as shown in Figure 2 above, which specifically impacted energy-intensive sectors negatively. |

| ▪ | The constraints imposed by the supply situation between 2011 and 2015 with the strong potential for suppressed demand by both industrial and domestic consumers. It was expected that suppressed demand would return once the supply situation had been resolved, but factors attributed to electricity pricing and commodity price issues might have delayed, or permanently removed, that potential. |

| ▪ | Improved energy efficiency, partly as a response to the electricity price increases. |

| ▪ | Increasing embedded generation. There is evidence of growing rooftop PV installations. Current installed capacity is still very small, however this is likely to increase in the medium to long term. |

| ▪ | Fuel switching from electricity to LPG for cooking and space heating. |

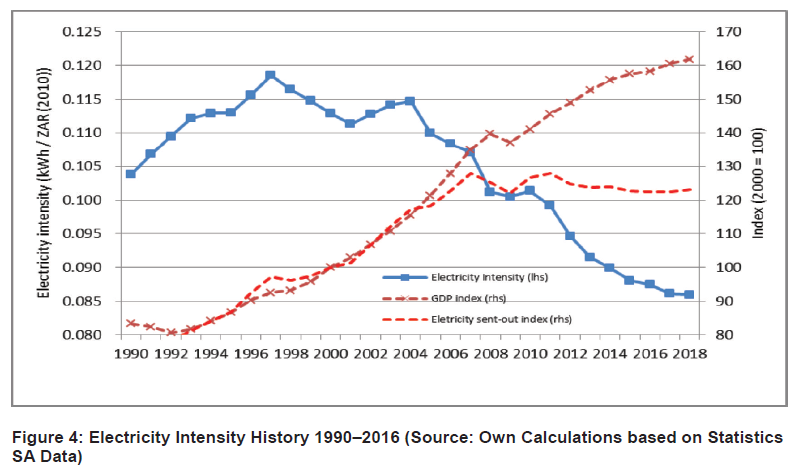

Further analysis of the historic electricity intensity trend indicated that electricity intensity also continued to decline over the past years, exceeding the decline expectation in the promulgated IRP 2010–2030 forecast. See Figure 4 below.

Figure 4 also points to possible decoupling of GDP growth from electricity intensity, which generally indicates a change in the structure of the economy.

The expected electricity demand as forecasted in the promulgated IRP 2010–2030 did therefore not materialise and the forecast was updated accordingly to reflect this.

| 4.1.2 | Electricity Demand Forecast for 2017–2050 |

The electricity demand forecast was developed using statistical models. The models are data-driven and based on historical quantitative patterns and relationships. Historical data on electricity consumption was key and information in this regard was obtained from various sources in the public domain. Overall consistency between sources was maintained by ensuring sector breakdowns corresponded with totals from Statistics SA data.

Using regression models per sector, sector forecasts were developed using sourced data. Sectoral totals were aggregated and adjusted for losses to obtain total forecasted values. Adjustments were also made to account for electricity energy imports and exports.

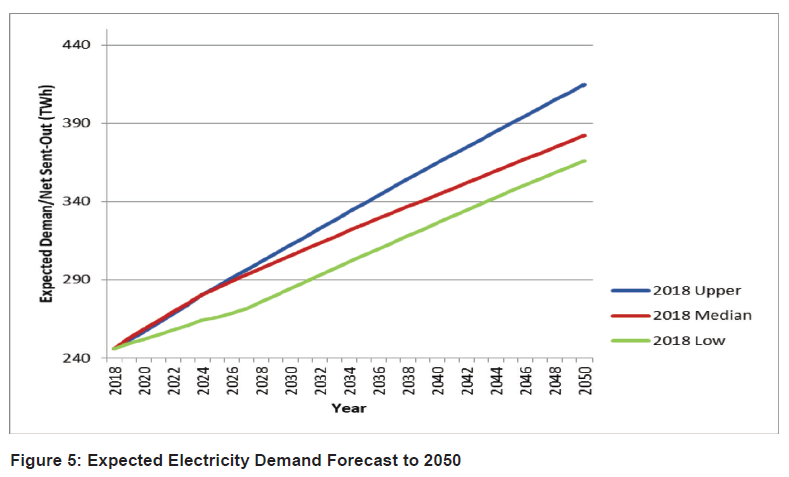

Figure 5 below depicts the total energy demand forecast as contained in the demand forecast report but adjusted to reflect the lower actual year-2018 demand as a starting point. The 2018 actual recorded demand is about a 3 percent lower than what was assumed in the draft IRP 2018.

The upper forecast3 is based on an average 3.18% annual GDP growth, but assumed the current economic sectoral structure remained. This forecast resulted in an average annual electricity demand growth of 2.0% by 2030 and 1.66% by 2050.

The median forecast4 is based on an average 4.26% annual GDP growth by 2030, but with significant change in the structure of the economy. This forecast resulted in an average annual electricity demand growth of 1.8% by 2030 and 1.4% by 2050. The median forecast electricity intensity dropped extensively over the study period (from the current 0.088 to 0.04 in 2050). That reflects the impact of the assumed change in the structure of the economy where energy-intensive industries make way for less intensive industries. The resultant electricity forecasts were such that, even though the median forecast reflected higher average GDP growth than the upper forecast, the average electricity growth forecast associated with the upper forecast was relatively lower than the average electricity growth forecast for the median forecast.

The lower forecast5 had a 1.33% GDP growth to 2030, which resulted in a 1.21% average annual electricity demand growth by 2030 and 1.24% by 2050. The lower forecast assumed electricity intensity initially increased before dropping all the way to 2050. In developing the forecast, the main assumption was that mining output would continue to grow while other sectors of the economy would suffer as a result of low investment. This scenario was developed when the country faced possible downgrading decisions by the rating agencies.

A detailed demand forecast assumptions report, including electricity intensity, can be downloaded from the DMRE website (http://www.energy.gov.za/files/irp_frame.html). Comments on the limitations of the forecasting methodology based on historical relationships as used in this IRP have been noted and will be considered for future enhancement of the forecast for IRP updates.

| 4.1.3 | Impact of Embedded Generation, Energy Efficiency and Fuel Switching on Demand |

With the changing electricity landscape and advancements in technology, there is an increasing number of own-generation facilities in the form of rooftop PV installations in households. There is also an increasing number of commercial and industrial facilities that are installing PV systems to supplement electricity from the grid.

High electricity prices, as well as technological advancements (improved equipment efficiency), are resulting in increased energy efficiency among consumers.

Equally, there is an increasing use of LPG for cooking and space heating that will impact both energy (kWh) and peak demand (kW). In line with municipal bylaws and building codes, new housing developments are installing solar water heaters in the place of full electric geysers. Voluntarily, consumers are also increasingly replacing electric geysers with solar water heaters to reduce their electricity bills.

These developments impact on overall electricity demand and intensity and must therefore be considered when projecting future demand and supply of electricity.

Due to the limited data at present and for the purpose of this IRP Update, these developments were not simulated as standalone scenarios, but considered to be covered in the low-demand scenario. The assumption was that the impact of these would be lower demand in relation to the median forecast demand projection hence the projected capacity was not discounted from the forecast.

________________________________________

3 The moderate forecast in its detailed forecast report.

4 The high less intense forecast in its detailed forecast report.

5 The junk status forecast in its detailed forecast report