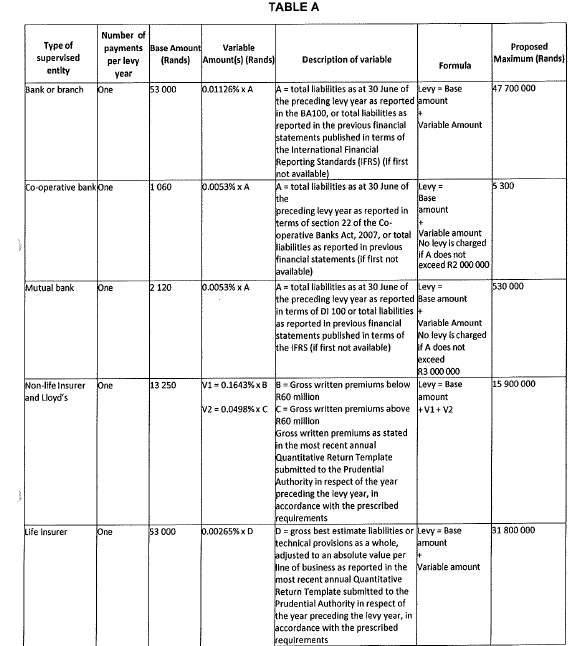

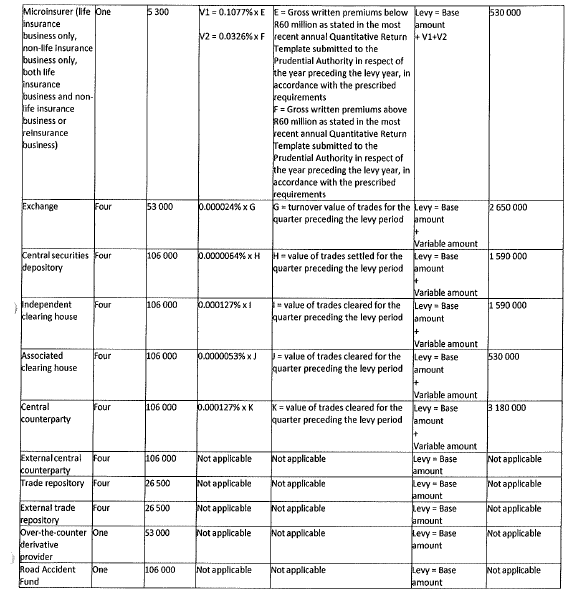

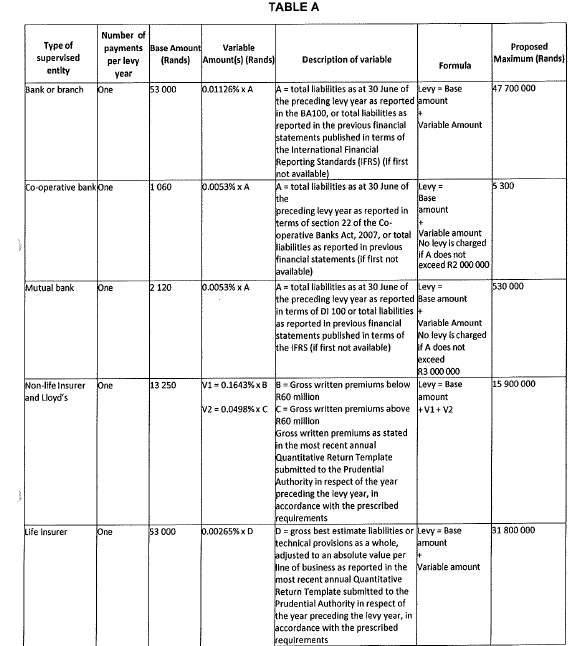

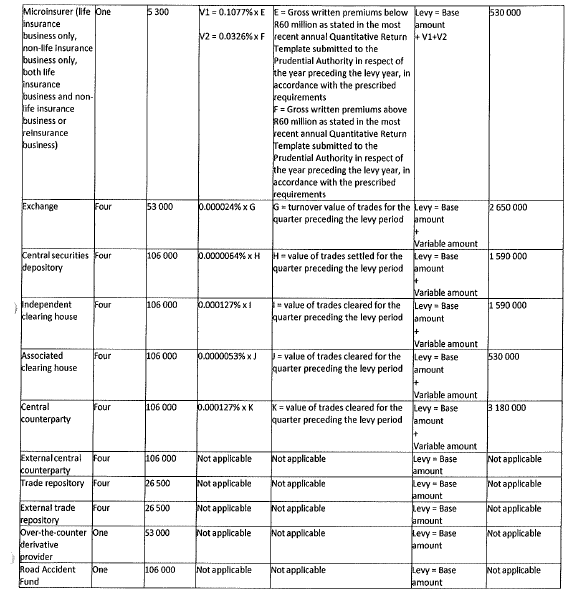

SCHEDULE 1

FINANCIAL SECTOR LEVY CALCULATION FOR SUPERVISED ENTITIES IN RESPECT OF PRUDENTIAL AUTHORITY

(Section 4(1)(b))

Application

| 1. | Table A must be applied to calculate the levy payable by a supervised entity that is— |

| (i) | a central securities depository; |

| (j) | an independent clearing house; |

| (k) | an associated clearing house; |

| (l) | a central counterparty; |

| (m) | an external central counterparty; |

| (o) | an external trade repository; |

| (p) | an over-the-counter derivative provider; or |

| (q) | the Road Accident Fund. |

Alleviation of double levy payment in respect of clearing house

| 2. | A clearing house that is approved in terms of section 110(6) of the Financial Markets Act to perform the functions of a central counterparty or a licensed independent clearing house who is also licensed as a central counterparty is liable to pay the levy applicable to a central counterparty, but is not liable to pay the levy applicable to an associated clearing house or an independent clearing house. |

Levy payment in respect of reinsurer

| 3. | A reinsurer that is licensed under the Insurance Act for— |

| (a) | non-life insurance business only, must pay the levy as if that reinsurer was a non-life insurer; |

| (b) | life insurance business, must pay the levy as if that reinsurer was a life insurer; or |

| (c) | both life insurance business and non-life insurance business, must pay the levy separately for the life insurance business and non-life insurance business. |

[Table A of Schedule 1 substituted by Notice No. 5613, GG51705, dated 4 December 2024]