Income Tax Act, 1962 (Act No. 58 of 1962)Notices2024 NoticesDetermination of the Daily Amount in respect of Meals and Incidental Costs for purposes of Section 8(1) of the ActSchedule |

| 1. | Unless the context otherwise indicates, any word or expression to which a meaning has been assigned in the Income Tax Act, 1962, bears the meaning so assigned. |

| 2. | The following amounts will be deemed to have been actually expended by a recipient to whom an allowance or advance has been granted or paid— |

| (a) | where the accommodation, to which that allowance or advance relates, is in the Republic and that allowance or advance is paid or granted to defray— |

| (i) | incidental costs only, an amount equal to R169 per day; or |

| (ii) | the cost of meals and incidental costs, an amount equal to R548 per day; or |

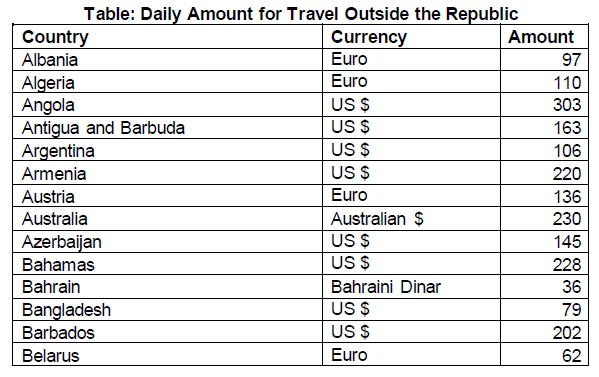

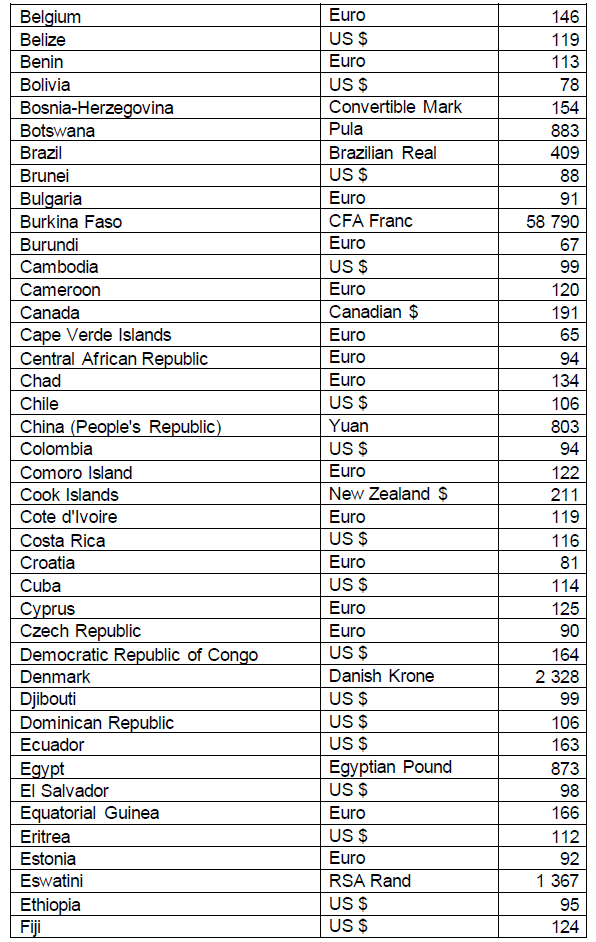

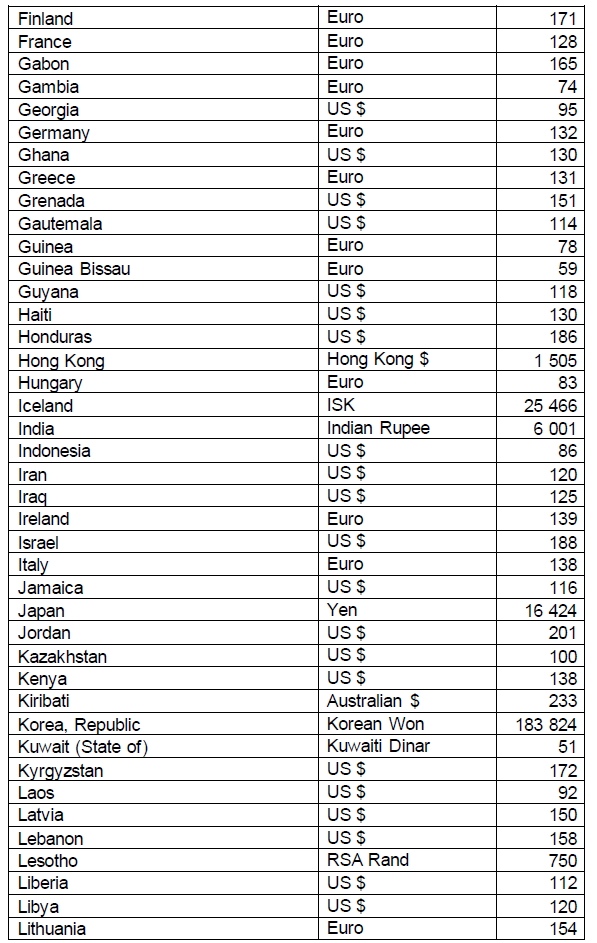

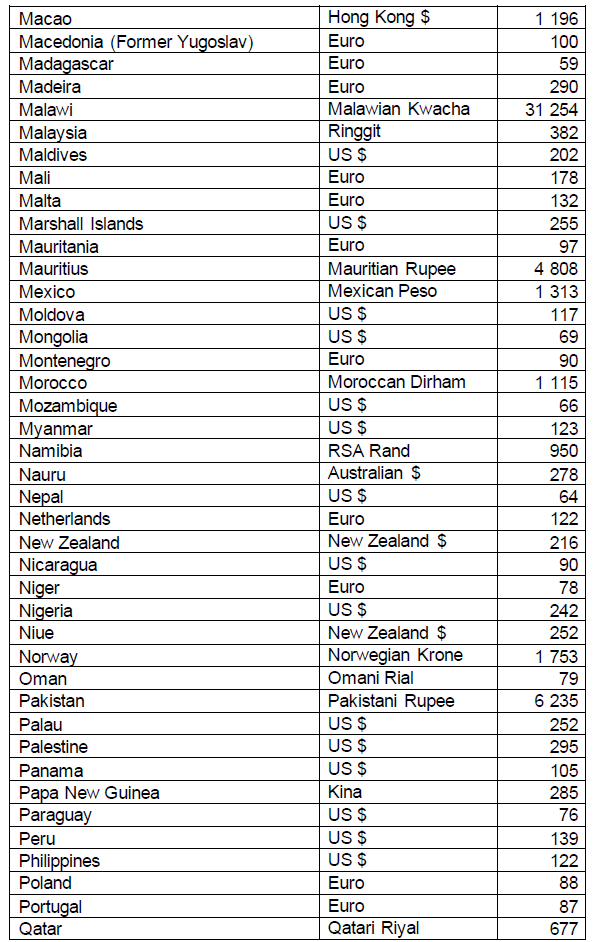

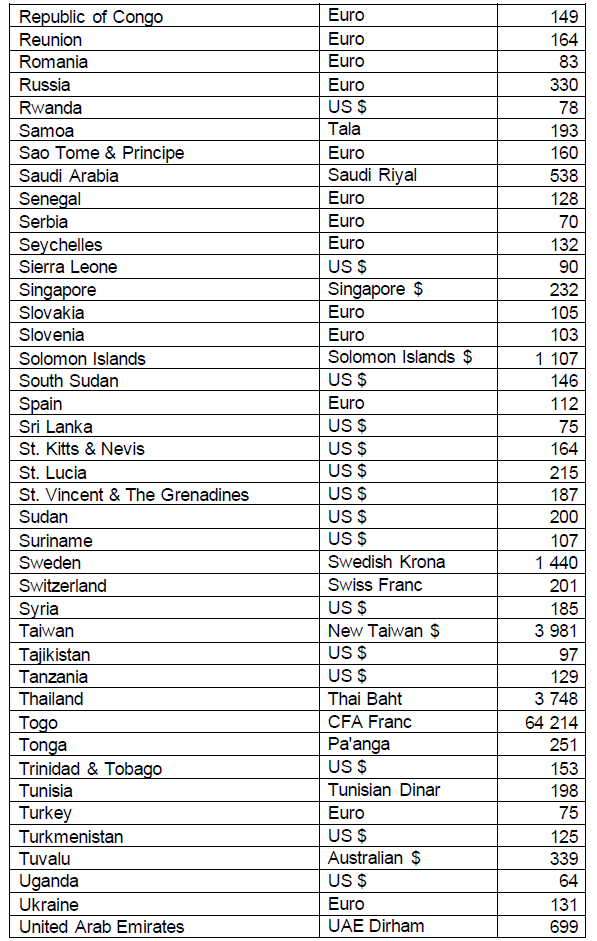

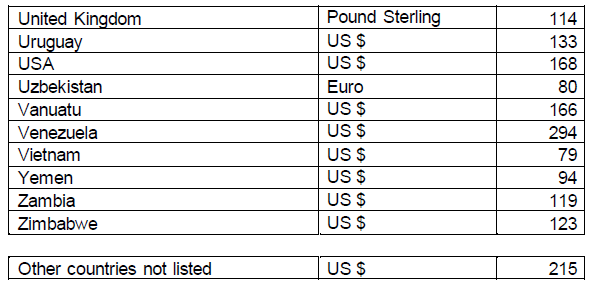

| (b) | where the accommodation, to which that allowance or advance relates, is outside the Republic and that allowance or advance is paid or granted to defray the cost of meals and incidental costs, an amount per day determined in accordance with the following table for the country in which that accommodation is located— |