Labour Relations Act, 1995 (Act No. 66 of 1995)NoticesNational Bargaining Council for the Private Security SectorMain Collective Agreement4. Remuneration |

| (1) | Minimum salary: |

| (a) | The ordinary salary which an employer shall pay employees shall be as specified in the tables listed below. |

| (i) | The hourly equivalents reflected in the table hereunder shall be used solely for the calculation of time worked in excess of the ordinary hours or for the deduction of monies from the ordinary salary for short time as defined or for any unauthorized absenteeism or any reduced ordinary hours of work as may be agreed between the employer and the employee in terms of "overtime" as defined in the definitions. |

| (b) | Subject to sub clause (a)(i) above, an employer shall pay to each member of the undermentioned classes of employees, other than casual employees, the minimum monthly salaries specified hereunder in Table 1, 2, 3 and 4— |

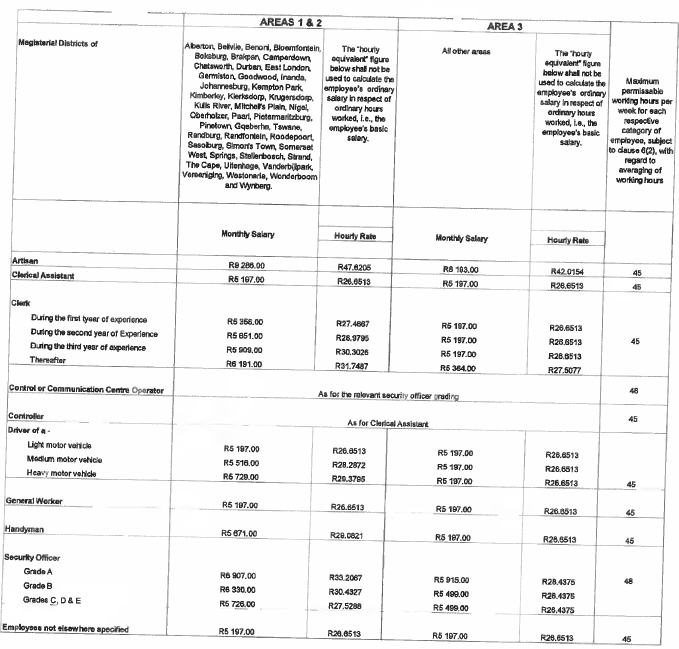

Table 1 - Monthly salary rate for year 1 of date of operation of this agreement of this. Effective from date of operation of this agreement to 28 February 2024

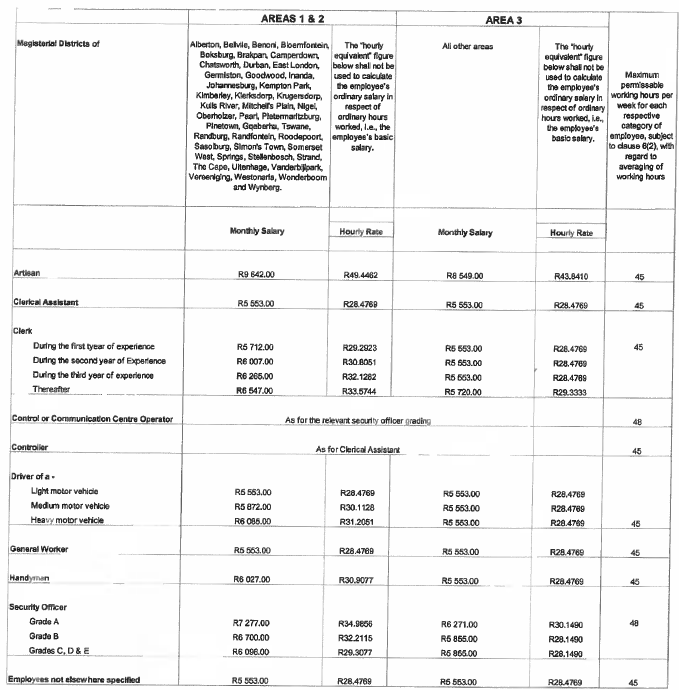

Table 2 - Monthly salary rate for year 2 of date of operation of this agreement. Effective 01 March 2024 to 28 February 2025

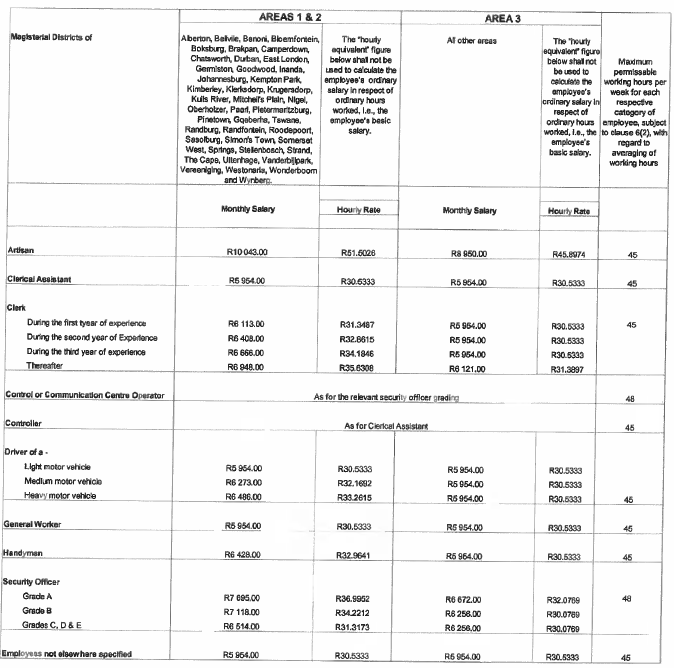

Table 3 - Monthly salary rate for year 3 of date of operation of this agreement. Effective 01 March 2025 - 28 February 2026

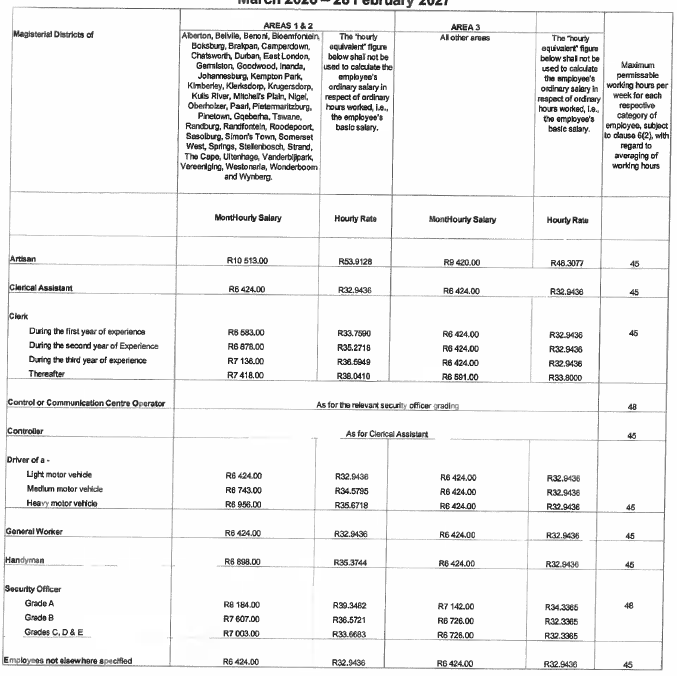

Table 4 - Monthly salary rate for year 4 of date of operation of this agreement. Effective 01 March 2026 - 28 February 2027

| (2) | Casual employees |

An employer shall pay a casual employee in respect of each hour or part of an hour (excluding overtime) worked by the employee on any day other than a paid Public holiday or a Sunday not less than the hourly wage as calculated in terms of clause 4(5)(b) for an ordinary employee who in the same area performs the same class of work as the casual employee is required to do, plus 15 percent, or not less than the hourly wage or hour1y equivalent of the salary actually being paid to the ordinary employee, whichever is the greater amount—

Provided that

| (i) | for the purposes of this paragraph the expression "the ordinary employee" means the employee who performs the particular class of work in the employer's full-time employ and who is being paid the lowest salary for that class of work; and |

| (ii) | where the employer requires the casual employee— |

| (aa) | to perform the work of a class of employee for whom salaries on a rising scale are prescribed, the expression "hourly wage" shall mean the hourly equivalent wage prescribed for a qualified employee of that class; and |

| (ab) | to work for a period of less than four hours on any day, the employee shall be deemed to have worked four hours and be remunerated accordingly. |

| (3) | Basis of contract: |

For the purposes of this clause, the contract of employment of an employee, other than a casual employee, shall be on a weekly basis.

| (4) | Differential salary: |

An employer who requires or permits a member of one class of employee to perform for longer than one hour on any day, either in addition to the employee's own work or in substitution therefore, work of another class for which—

| (a) | Salary is higher than that of the employee's own class is prescribed in clause 4(1), shall pay to such employee in respect of that day not less than the daily equivalent calculated at the higher rate; or |

| (b) | a rising scale of remuneration resulting in a salary higher than that of the employee's own class, as prescribed in sub clause 4(1), shall pay to such employee in respect of that day not less than the daily salary calculated on the notch in the rising scale immediately above the salary which the employee was receiving for the employee's ordinary work: provided that— |

| (aa) | this sub clause shall not apply where the difference between the classes in terms of sub clause 4(1) is based on experience; and |

| (ab) | unless expressly otherwise provided in a written contract between the employer and employee, nothing in this agreement shall be so construed as to preclude an employer from requiring an employee to perform work of another class for which class the same or a lower salary is prescribed for such an employee. |

| (5) | Calculation of salary |

The ordinary salary, overtime and Sunday time of an employee, other than a casual employee, shall be calculated on a monthly basis and an employee shall be paid accordingly.

| (a) | The monthly salary of an employee shall be as stipulated in the relevant column of the tables 1,2, 3 and 4; and |

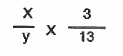

| (i) | Any hours in excess of the maximum daily or weekly ordinary hours or, if applicable, average weekly ordinary hours, as well as any hours in respect of work performed on a Sunday or public holiday, shall be calculated by using the formula below to determine the "hourly equivalent" figure and applying the relevant premium: |

Where: |

x= monthly salary as per clause 4(1)(b) defined in Table 1, 2, 3 and 4. |

and |

y= ordinary hours per week as per clause 7(1) |

| (b) | The "hourly equivalent" figure shall not be used to calculate the employee's ordinary salary in respect of ordinary hours worked, i.e., the employee's basic salary. |

| (6) | Allowances |

| (a) | Special Allowances |

The following allowances shall be paid per shift, to each employee performing the following duties, on condition that no employee shall be entitled to accumulate more than any two of these special allowances in respect of any shift worked.

Special Allowances |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Mobile Supervisor |

R8.50/shift |

R9.50/shift |

R9.50/shift |

R10.50/shift |

Armed Security Officer |

R8.50/shift |

R9.50/shift |

R9.50/shift |

R10.50/shift |

Armed Response Officer |

R8.50/shift |

R9.50/shift |

R9.50/shift |

R10.50/shift |

National Key Point Officer |

R8.50/shift |

R9.50/shift |

R9.50/shift |

R10.50/shift |

Control Centre Operator |

R8.50/shift |

R9.50/shift |

R9.50/shift |

R10.50/shift |

Canine/Dog Handler |

R9.50/shift |

R9.50/shift |

R10.50/shift |

| (b) | Night shift allowance |

If at least half of the shift ordinarily falls between the hours of 18:00 on the one day and 06:00 the next day that employee will be entitled to and shall receive an allowance in respect of each night shift worked as below.

Night Shift Allowance |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Night Shift Allowance |

R6.00/shift |

R7.00/shift |

R7.00/shift |

R8.00/shift |

| (c) | Cleaning allowance |

An employer who provides and requires and employee with uniform apparel, may require the employee to clean it in the employee's own time, in which event the employer shall pay the employee not less than the amounts specified below per month, which shall however not be payable during periods of absence from work.

Cleaning Allowance |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Cleaning Allowance |

R30.00/month |

R31.00/month |

R31.00/month |

R32.00/month |

| (d) | Transfer allowance |

An employer shall pay a security officer a transfer allowance as specified below per month under the following circumstances—

| (i) | If the transfer is permanent, the employee shall be entitled to the transfer allowance for a period of not more than 12 (twelve) months after the date of transfer; |

| (ii) | If the employee is transferred for a period exceeding six months but not exceeding twelve months, he/she shall be entitled to receive the transfer allowance for the equivalent number of months as the transfer; |

| (iii) | All transfer allowance payments are subject to the following conditions: |

| (aa) | The employer requires the security officer to transfer on a permanent basis or for a period exceeding six months; and |

| (bb) | The security officer is transferred to a site or other such business which is in excess of 60 kilometres away from the deployment of the security officer at the time of the transfer. |

| (iv) | This clause does not apply in the event: |

| (aa) | of a transfer arising from an offer of alternate employment by the employer during a consultation process conducted in terms of section 189 of the Labour Relations Act (66 of 1995) as amended; or |

| (bb) | that the transfer of the employee is the result of a request for such transfer by the employee. |

Transfer Allowance |

Years 1, 2, 3 and 4 |

Transfer Allowance |

R100.00/month |