Legal Practice Act, 2014 (Act No. 28 of 2014)RulesFinal Rules as per section 95(1), 95(3) and 109(2) of the Legal Practice Act 28 of 2014SchedulesSchedule 7B |

Schedule 7B

(Rule 49)

LEGAL PRACTITIONERS' FIDELITY FUND

APPLICATION FOR FIDELITY FUND CERTIFICATE IN TERMS OF THE LEGAL PRACTICE ACT, 2014 (ACT NO. 28 OF 2014)

APPLICATION FORM FOR ADVOCATES referred to in section 34(2)(b) of the Legal Practice Act

PLEASE COMPLETE IN BLOCK LETTERS

GENERAL INFORMATION

| 1. | Full names of the applicant: ___________________________________________ |

Identity number:_____________________________________________________

Practitioner reference number: ________________________________________

| 2. | Physical address at which practice will be carried on (i.e. principal place of practice) |

______________________________________________________________________

______________________________________________ Province: ________________

| 3. | Contact details: |

Postal address:___________________________________________________________

Residential address:_______________________________________________________

Docex address if applicable):________________________________________________

Telephone (business): _________________________ (home):_____________________

(fax): ___________________ (e-mail):_________________________________________

| 4. | Any other physical address at which practice will be carried on, including province: |

____________________________________________________ Province:_______________

| 5. | If no Fidelity Fund Certificate has been obtained for the current year, state date on which the applicant will begin to practise: _____________________________ |

| 6. | If applicant ceased to practise, and intends to resume practising, state: |

Name and address of former practice:_________________________________________

_____________________________________________ Province:_____________________

When applicant ceased to practise:_____________________________________________

ADDITIONAL INFORMATION REQUIRED BY THE LEGAL PRACTITIONERS' FIDELITY FUND FOR RISK MANAGEMENT AND ANALYSIS

| 7. | Registration number with the Financial Intelligence Centre (attach proof):___________ |

| 8. | Appointed auditor: __________________ Practice registration number: _______________ |

Firm name:___________________________________________________________________

Physical address:______________________________________________________________

Postal address:_______________________________________________________________

Telephone (business):_______________________________ (fax):_____________________

E-mail address:________________________________________________________________

| 9. | The applicant participated I did not participate in the automated monthly transfer system for the period from _______________20_____ to _____________ 20______. |

| 10. | The applicant provides, or facilitates or arranges for the provision of, bridging finance to clients: YES / NO. |

| 11. | The applicant carried on the business of an investment practice during the year: YES / NO. |

If yes, the investment practice registration in terms of the Financial Advisory and Intermediary Services Act, No. 37 of 2002, with the Financial Services Board is:___________________________________________________________________

| 12. | The applicant purchased I did not purchase— |

| 12.1 | insurance cover to protect against the possibility of misappropriation of trust money and property; |

| 12.2 | professional indemnity insurance cover If such insurance was acquired, state in each case the extent of the cover, the name of the insurer and the policy number. |

| 13. | The legal practitioner is required to complete and return the attached risk questionnaire for analysis and risk management by the Attorneys Insurance Indemnity Fund. |

FINANCIAL INFORMATION

| 14. | As the legal practitioner I am responsible for ensuring that my trust accounts are maintained in compliance with the provisions of the Legal Practice Act, 28 of 2014 ("the Act") and the rules of the Legal Practice Council ("the Council"). I am responsible for the design, implementation and monitoring of accounting and internal control systems and the completion of the risk assessment of the firm. |

| 14.1 | I confirm that I have maintained the necessary accounting records as required in terms of sections 87(1) and 87(3) of the Council for the accounting period from 1 October 20____ to 30 September 20____. |

| 14.2 | I certify that: |

| 14.2.1 | the accounting records, to the best of my knowledge and belief, are in accordance with the terms of the Act and the rules of the Council; |

| 14.2.2 | any trust deficit was reported to the Council; |

| 14.2.3 | interest earned in terms of sections 86(5) of the Act was paid to the Council in full on a monthly basis; |

| 14.2.4 | the annual fees and charges are fully paid up. |

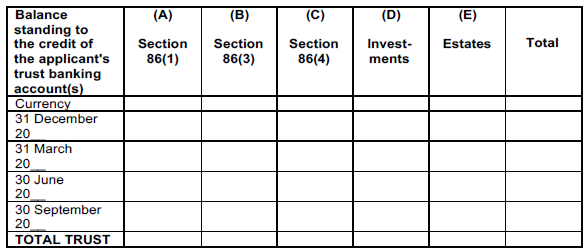

| 14.3 | state the amount (as per the bank statement) standing to the credit of the firm's trust banking account(s) and the amount of trust monies invested by the applicant's firm at the end of each quarter of this year, per financial institution: |

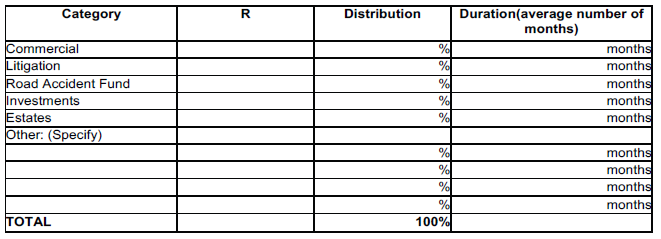

| 14.4 | Analysis of section 86(4) investments by category at 30 September 20____: |

| 14.5 | I hereby authorise the above bank/s to provide the Legal Practitioners' Fidelity Fund with details of any changes to, and to certify, the above information, from time to time, as requested by the Fund. |

I hereby authorise the Legal Practitioners' Fidelity Fund to negotiate with my bankers the terms relating to interest accruing on, and bank charges levied against, my trust current banking account(s).

SIGNED ON THIS ______ DAY OF _________________ 20____ AT ______________________________.

___________________________

SIGNATURE OF APPLICANT

GUIDELINES FOR COMPLETING THIS FORM

This form must be completed in advance for the coming year.

The form should be submitted by 1 December of each year for a certificate in respect of the following year.

If commencing practice for the first time the application will be in respect of the current year.

The information requested in this application form will, inter alia, be used by the Legal Practitioners' Fidelity Fund to provide statistics for risk management, risk profiling and reinsurance programmes.

| Item 14.3: | The amount (as per bank statements) standing to the credit of the firm's trust banking account, the amount of trust moneys invested by the applicant's firm, estate accounts and other entrusted property: |

A - Insert the balance standing to the credit of the trust current banking account as per the bank statement as at the end of each quarter. If there is more than one trust account, add the balances together and enter the result in A for each quarter.

B - Insert the total of the amounts invested in terms of section 86(3) in B for each quarter.

C - Insert the total of the amounts invested in terms of section 86(4) in C for each quarter. On this type of investment the interest generated is payable to the practitioner's client(s), and to the Legal Practitioners' Fidelity Fund in terms of section 86(5)(b).

D - Insert the total of the amounts invested in terms of the Council's investment rules in D for each quarter.

E - Insert the total amount held in respect of estates in terms of section 87(3)(c) of the Act in E for each quarter.

F - Insert the value of any other entrusted property in terms of section 55(1) of the Act, in F for each quarter.

Use annexures if there is more than one account and financial institution.

For trust funds denominated in any foreign currency, provide a separate annexure in the same format noting the currency.

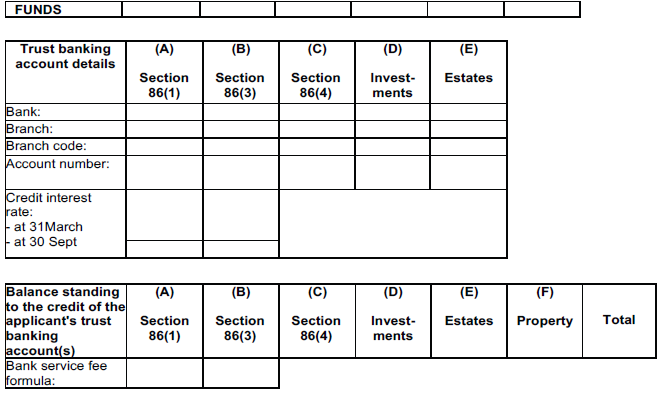

Trust current banking account details:

| (a) | Enter name of bank. |

| (b) | Enter name of branch. |

| (c) | Enter branch code. |

| (d) | Enter bank account number. |

| (e) | Enter the credit interest rate applied to the account as at the dates specified. These dates relate to the current year. If the rates are not shown on the bank statements, practitioners should contact their bank managers to get the correct information. If the rate fluctuates depending on the size of the balance in the account, indicate the rate on balances in excess of R100 000. |

| (f) | The bank service fee formula must be entered as at 30 September of the current year. The service fee formula is normally printed on the bank statement in the following way: |

_ _ _/ _ _ _ / _ _ _ _

The first 3 digits are the charge for the first R100 of each cheque issued, expressed in cents.

The next 3 digits are the charge for each additional R100 of each cheque

issued.

The last 3 or 4 digits are the maximum charge per cheque issued.

Use annexures if space is insufficient and for information on multiple accounts.

| Item 14.4: | You are required to provide your own assessment of the nature of section 86(4) trust investments at 30 September, expressed as a percentage, and the average duration of each type of investment. |

Insert percentages to indicate the nature of section 86(4) trust investments.

Also insert the average duration of each investment type.