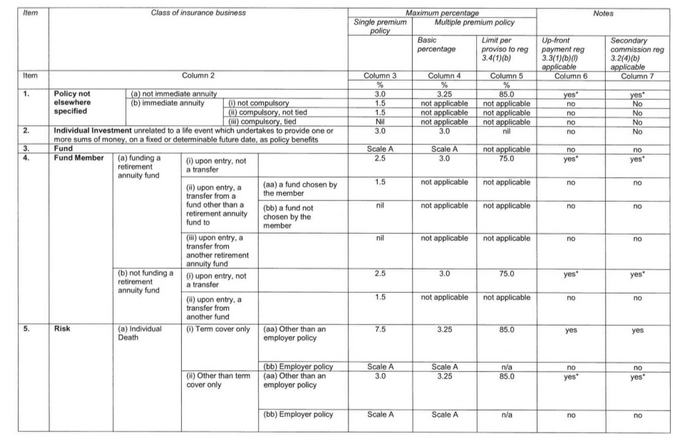

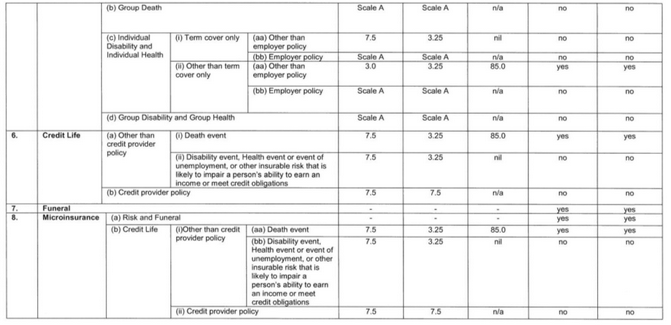

Long Term Insurance Act, 1998 (Act No. 52 of 1998)RegulationsRegulations under the Long-term Insurance Act, 1998Part 3 : RemunerationPart 3A : Limitation on Remuneration for Rendering Services as Intermediary - Policies other than Policies to which Part B AppliesAnnexure 1Table 2 : Licensed insurers |

TABLE 2 : LICENSED INSURERS

In this Table—

"Credit Life" means a life insurance policy written under the Credit Life class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"credit provider policy" means a policy referred to in paragraph (a)(i) of the definition of "individual" as defined in Schedule 2 of the Insurance Act;

"death event" has the meaning assigned to such term in section 1 of the Insurance Act;

"employer policy" means a policy referred to in paragraph (a)(ii) of the definition of "individual" as defined in Schedule 2 of the Insurance Act;

"Fund" in item 3 means a fund policy;

"Fund Member" in item 4 means a fund member policy;

"Funeral" means a life insurance policy written under the Funeral class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Group Death" means a policy written under sub -class "e" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Group Disability" means a policy written under sub -class "g" or "h" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Group Health" means a policy written under sub -class "f" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Individual Death" means a policy written under sub -class "a" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Individual Disability" means a policy written under sub -class "c" or "d" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Individual Health" means a policy written under sub -class "b" of the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"Individual Investment" means a life insurance policy, excluding a fund member policy, written under the Individual Investment class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

"life event" has the meaning assigned to such term in section 1 of the Insurance Act;

"Microinsurance" means a life insurance policy written by a microinsurer as defined in section 1 of the Insurance Act; and

"Risk" means a life insurance policy written under the Risk class of life insurance business as set out in Table 1 of Schedule 2 of the Insurance Act;

Notes to Table 2 of Annexure 1:

| • | An asterisk (*) denotes "excluding a replacement policy" |

| • | A dash (-) denotes that there is no limit. |

| • | "nil" denotes that no commission may be paid. |

| • | A policy, other than one that provides an immediate annuity, that is a fund member policy or a fund policy falls under item 3 or 4, as the case may be, irrespective whether it can fall also under another item. A policy that provides an immediate annuity that is a fund member policy of a fund policy attracts the commission referred to in item 1(b) |

[Annexure 1(Table 2) inserted by regulation 5(o)(ii) of Notice No. 1015, GG 41942, dated 28 September 2018]