Local Government: Municipal Systems Act, 2000 (Act No. 32 of 2000)NoticesUpper Limits of Total Remuneration Packages Payable to Municipal Managers and Managers Directly Accountable to Municipal Managers13. Transitional provisions |

| (1) | This Notice does not affect the existing employment contract of a senior manager appointed before 1 July 2014. |

| (2) | A municipality that does not have any municipal income is a category 1 municipality. |

| (3) | A superseding municipality that came into effect at the commencement of the first election of the council of that municipality after the 2016 local government elections with different categories, must utilise the highest total municipal income between one of the superseding municipalities based on the audited financial statements for the 2015/16 financial year. |

| (4) | A superseding municipality s that came into effect at the commencement of the first election of the council of that municipality after the 2016 local government elections with the same category, must utilise the highest total municipal income between one of the superseding municipalities based on the audited financial statements for the 2015/16 financial year. |

| (5) | If a municipality has no audited financial statements for 2015/16 financial year by the date of publication of this Notice, the audited financial statements for 2014/15 financial year will apply. |

| (6) | A municipal council may, in exceptional circumstances and good cause shown, and after consultation with the MEC for local government, apply in writing to the Minister to waive any of the prescribed requirements as set out in this Notice. The Minister will consider each application on merit, based on the circumstances and motivation provided. |

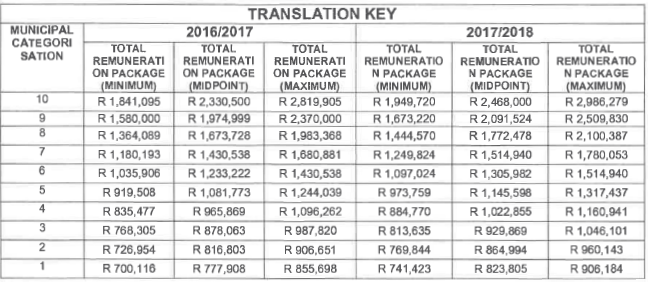

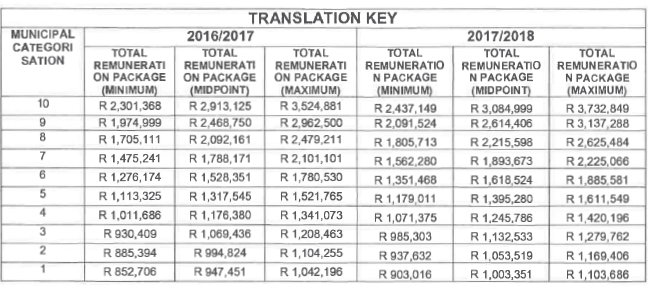

| (7) | For purposes of the total remuneration packages adjustment for serving senior managers, the following translation key will apply— |

| (a) | Municipal managers: |

| (b) | Managers directly accountable to municipal managers: |