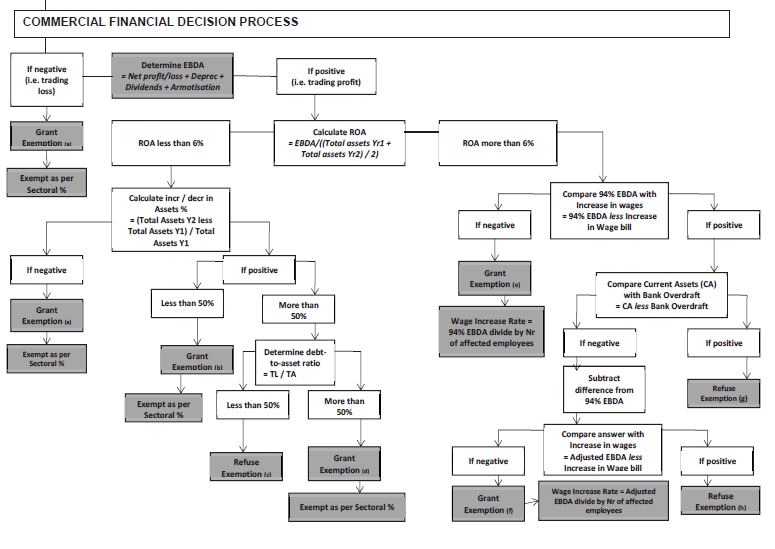

National Minimum Wage Act, 2018 (Act No. 9 of 2018)RegulationsRegulations to the National Minimum Wage, 2018SchedulesSchedule 1 : Commercial Financial Decision Process |

System notes:

| (a) | The applicant cannot afford due to insufficient profitability and assets. Thus exemption granted. |

| (b) | The applicant cannot afford due to insufficient profitability and assets. Thus exemption granted. |

| (c) | Profitability and assets based calculations indicates the applicant can afford. Thus exemption refused. |

| (d) | Profitability and assets based calculations indicates the applicant cannot afford. Thus exemption granted. |

| (e) | Profitability calculations indicate the applicant cannot afford. Thus exemption granted. |

| (f) | Profitability and liquidity based calculations indicate the applicant cannot afford. Thus exemption granted. |

| (g) | Profitability and liquidity based calculations indicate the applicant can afford. Thus exemption refused. |

| (h) | Profitability and liquidity based calculations indicate the applicant can afford. Thus exemption refused. |

Acronyms:

• EBDA – Earnings before Depreciation and Dividends Allowance

• TL – Total Liabilities

• TA – Total Assets

• ROA – Return on Assets

• CA – Current Assets

• CL – Current Liabilities

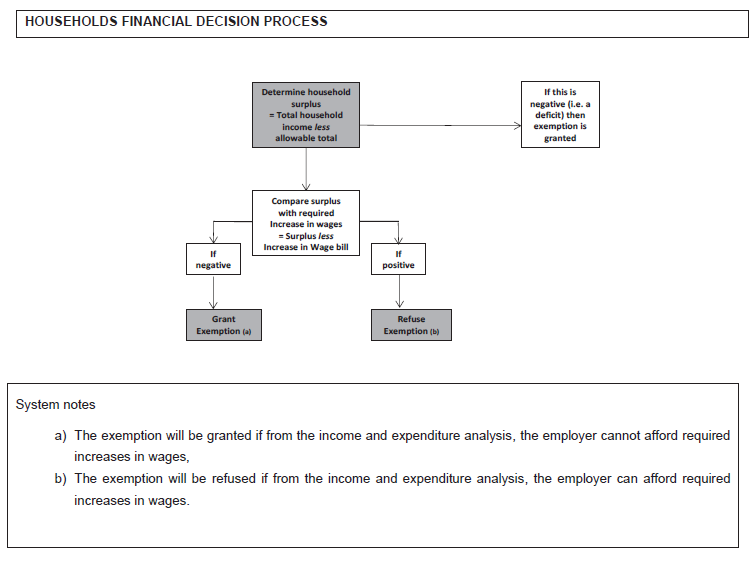

Exemption will be granted if:

| (a) | The applicant cannot afford to pay the prescribed increase in minimum wages |

| (b) | To test affordability [commercial] elements of Profitability, Liquidity and Solvency, are taken into account. |

Exemption will be refused if:

| (a) | The applicant appears to be able to afford to pay the prescribed increase in minimum wages, taking the elements of Profitability, Liquidity and Solvency, into account. |

Audit Triggers

| • | The required financial information above is captured on the system. The system will immediately perform tests to determine the presence of any of the following audit triggers based on determined percentages (Commercials) and discrepancies between financial years data: |

| • | Discrepancies in depreciation |

| • | Out of proportion net losses |

| • | Discrepancies in donations, entertainment, write-offs and loss on disposal of assets |

| • | Discrepancies in reported total expenditure |

| • | Discrepancies in reported revenue |

| • | Discrepancies in non-current assets |

| • | Discrepancies in total liabilities |

| • | For individual household applicants, an audit is triggered if the amount captured by the user is more than the set cap [Stats SA: Living Conditions]. |

Affordability

| • | Affordability tests for businesses are based on the assessment of the elements of 1) Profitability, 2) Liquidity and 3) Solvency positions. |

| • | Analysis begins by determining increases required on the employer’s wage costs to comply with legislated minimum wage. This is the difference between the rate that the employer is currently paying and the rate required by Department of Labour. |

| • | The steps to follow, in the financial analysis, are then aimed at determining whether the above difference can be afforded by the employer. |

| • | NB: Financial analysis is only conducted if the applicant’s financial information does not trigger any audit keys mentioned above. |

Profitability

| • | Profitability is the primary consideration in the entire financial analysis [commercial]. Depreciation expenditure and dividends are added back to the reported profit. The result of this process will be referred to as Earnings before Depreciation Allowance (EBDA). |

| • | The calculated EBDA is used to determine employers’ Returns on Assets (ROA). |

| • | ROA = EBDA / Average Assets. |

| • | If the calculated ROA is less than 6%, then Solvency tests are conducted in order to gain further insight into the financial asset structure of the business (See “Solvency” below) |

| • | If the calculated ROA is more than 6%, then the required increase in wages is compared to 94% of the EBDA. If the required increase in wages can be accommodated, then further tests of Liquidity are conducted. However, if the required increase in wages cannot be accommodated within the 94% of EBDA, then the applicant qualifies for an exemption and no further tests are performed. |

Liquidity

| • | Liquidity analysis is conducted only if the profitability analysis above indicates that the required increase in wages can be accommodated within the 94% of the EBDA. |

| • | The total liquid assets such as debtors, inventory and other current assets are compared against the bank overdraft. |

| • | If these liquid assets cannot cover the bank overdraft, the required shortfall is deducted from 94% of the EBDA to get the adjusted EBDA. Required increase in wages is then compared with this adjusted EBDA. If this required increase in wages cannot be covered from the adjusted EBDA, the employer’s application for exemption will be granted. However, if the increase can be covered from the adjusted EBDA, the application will be refused. |

| • | If the liquid assets can cover the bank overdraft the application will be refused. |

Solvency

| • | Solvency analysis is conducted only if the profitability analysis above indicates that ROA is less than 6%. |

| • | The analysis first determines if there was an increase or a decrease in the applicant’s assets, and to what percentage. |

| • | If there was an increase in the average assets of the applicant, of more than 50%, then a debt-to-asset ratio is determined. This ratio is used to ascertain how much of that increase was financed through debt. |

| • | If the debt-to-asset ratio is more than 50% (i.e. more than 50% of assets are owned by creditors), the applicant will be granted an exemption. However, if the debt-to–asset ratio is less than 50%, the application will be refused. |

| • | If there was a decrease in the average assets of the applicant, the application for exemption will be granted. |

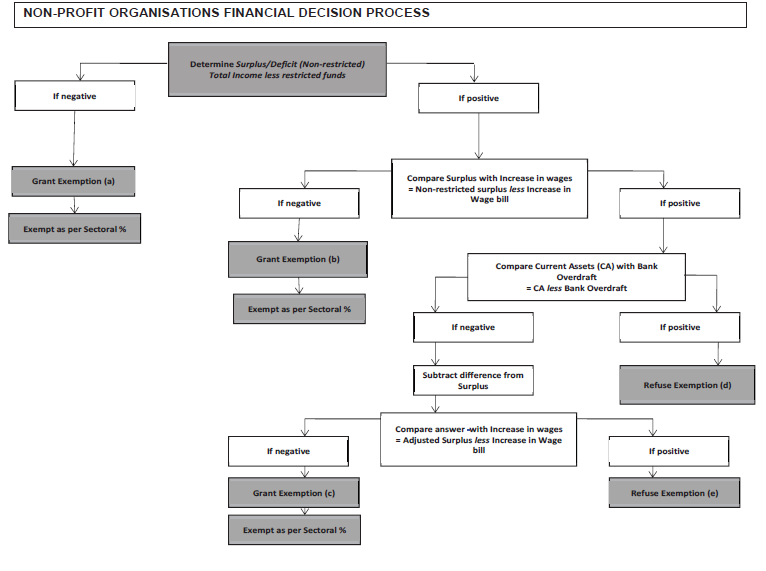

Non-Profit Organisations: System Notes

| (a) | The applicant cannot afford due to a deficit from income versus expenditure analysis. Thus exemption granted. |

| (b) | The applicant cannot afford due to insufficient surplus from income versus expenditure analysis. Thus exemption granted. |

| (c) | Surplus and liquidity based calculations indicate that the applicant cannot afford. Thus exemption granted. |

| (d) | Surplus and liquidity based calculations indicate that the applicant can afford. Thus exemption refused. |

| (e) | Surplus and liquidity based calculations indicate that the applicant can afford. Thus exemption refused. |