Postal Services Act, 1998 (Act No. 124 of 1998)RegulationsPrice Cap Amendment Regulations for Reserved Postal Services, 20213. General Price Control Formula |

| (1) | The Licensed Operator shall ensure that in each price control year the price charged for the reserved services shall be set to satisfy the criteria in the formulae below: |

Formula [(RRt ÷ RRt-1) - 1] x 100

Where—

| t: | is the current year in the price control period; |

| t-1: | is the preceding year; |

| (2) | RRt is the reported revenue of the Licensed Operator in year “t” of all the reserved postal services and is calculated as follows: |

[RR = (RAB x WACC) + E + D + F ± C + T]

Where:

RR |

= |

is the required revenue of the Licensed Operator for all the reserved postal services rendered |

RAB |

= |

Regulatory asset base |

WACC |

= |

Weighted average cost of capital |

E |

= |

Expenses: operating and maintenance expenses |

D |

= |

Depreciation and amortisation of inflation write-up: the charge |

F |

= |

Approved revenue addition to meet debt obligations for the price control period under review |

C |

= |

Claw back adjustment: to correct for differences between actuals and forecasts in formula elements from a preceding price control period (i.e. year t-1) in relation to the actuals for the price control period under review (i.e. year t) |

T |

= |

Tax expense: estimated tax expense |

| (a) | The calculation of each of these components will be done in accordance with the guidelines set by the Authority and the Accounting Separation Regulations for Reserved Postal Services, 2011 (GG 34130). |

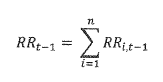

| (3) | RR t-1 is the reported revenue of the Licensed Operator in year "t-1" of all the reserved postal services and is calculated as follows: |

Where—

| n: | is the number of reserved postal products and services |

| (4) | The following formulation must be used to determine the Required Revenue: |

| (a) | The licensed operator shall ensure that in each price control year, the price charged for reserved postal services shall be set to satisfy the following conditions: |

| (i) | recover the reasonable operational and maintenance expenses incurred in bringing services to bear in the year in which they are incurred; and |

| (ii) | recover capital investment and make profit (based on an allowed rate of return) thereon commensurate with the risk undertaken; |

| (b) | The prices charged must relate and be traceable to investment in, operation and maintenance of, and profits arising only from those parts of the reserved activity. |

| (c) | As prices are based on computed Required Revenue for the price control period under review, the Required Revenue contemplated must include: |

| (i) | reasonable operating expenses; |

| (ii) | reasonable maintenance expenses; |

| (iii) | depreciation expenses; |

| (iv) | reasonable working capital; |

| (v) | reasonable rate of return (i.e. WACC) on the assets employed for reserved activity; and |

| (vi) | other applicable obligations (e.g. tax and USO, all of which must be verified by the Authority). |

[Regulation 3 substituted by Section 3 of Notice No. 924, GG45217, dated 23 September 2021 - effective 1 April 2022]